Medicare Plan G: Costs and Benefits in [mpf name="current_year"]

April 23, 2020Before reading further, please note the very important fact listed below about Medicare supplement insurance benefits and cost that can easily be found and verified directly on Medicare’s website by going here.

Key Fact About Medicare Supplement Plan G and other Plans.

“The benefits in each lettered plan are the same, no matter which insurance company sells it. The premium amount is the only difference between policies with the same plan letter sold by different companies.” – Centers for Medicare and Medicaid’s Medicare and You Handbook 2025 – page 77, paragraph 1.

So, then what?

This means that if you know a Medicare supplement is the right type of insurance for you, you are simply shopping the price, and the prices can vary greatly due to many variables. It’s important to understand the rate history and claims paying ability of the insurance company you choose as that is a great indicator if you will be subject to excessive future rate increases vs. future rate stability and moderate increases.

Do not let a low price tag fool you and lock you into the wrong insurance company.

Now, lets dive into more detail about the Plan G Medicare supplement.

What is Medicare Supplement Plan G?

Medicare Plan G is one of several Medigap Plans you can buy from a private company to pay healthcare costs not covered by Medicare Part A and Medicare Part B. Medigap plans are often referred to as Supplemental plans as well.

These plans help cover co-payments, deductibles, and coverage during international travel.

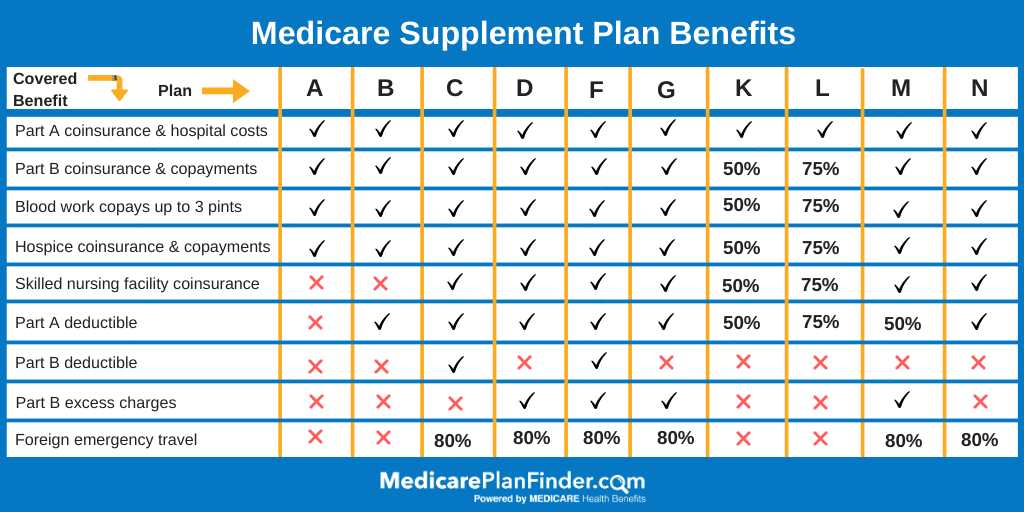

Medigap plans are identified by letter, A through N. Current offerings include Plans A, B, C, D, F, G, K, L, M and plan N. Plans E, H, I, and J are no longer available to new subscribers.

It’s important to note that Medigap Plans A, B, C, and D are not the same as Medicare Parts with the same corresponding letters. Medicare has four parts, but Medigap policies are referred to as plans.

Overall, about 1 in 5 Medicare enrollees also purchase a Medigap plan.

Each plan is different in terms of exact coverage and costs. There are a variety of plans so that you can buy a plan that best fits your individual needs.

Plan G is characterized by providing excellent benefits to beneficiaries who want to pay a small annual deductible. That protects them from spending more on out-of-pocket expenses for unexpected health issues.

It is similar to Medicare Plan F, which prior to it being cancelled, was the most popular Medigap plan.

Medicare Plan G: Who is it for?

Many people choose Plan G because it’s the most comprehensive plan available as of 2025. For individuals who prefer to have more control over their expenses, plan G is a strong choice for Medicare supplement as it’s very clear what the monthly costs are.

However, to decide if Plan G is right for you, it’s best to take a closer look at the specific benefits. You may also want to look at other plans to see if one is better suited for you as well. A common plan many choose over a plan G is a plan N due to the premium being lower in exchange for copays at the doctor, ambulance rides and ER visits.

What Medicare Plan G covers

Plan G covers all the gaps in Part A and Part B coverage, except for the Part B deductible. Specifically, those benefits include:

- Part A deductible

- Part A coinsurance and hospital costs

- Part B coinsurance and co-payments

- Blood work, and the first three pints of blood for medical needs

- Hospice care co-payments and coinsurance

- Foreign travel medical emergencies (up to $50,000)

- Skilled nursing facility coinsurance

- Outpatient medical services such as lab work, diabetes supplies, durable medical equipment, doctor visits, ambulance services, and more.

All Medigap plans do not include prescription drug coverage. You will need to buy a Part D plan to be covered unless medications are prescribed as part of Plan B coverage and include drugs such as for chemotherapy or autoimmune diseases that must be administered in a clinical setting.

Also, Medigap plans do not cover routine dental care.

How Medigap Plan G works with Original Medicare

To sign up for a Plan G policy, you must first be enrolled in Medicare Part A and Part B.

Original Medicare will pay its share of the Medicare-approved amount for covered services. Plan G will then pay its share.

It’s important to note that you cannot have a Medicare Part C plan and a Medigap plan in force at the same time.

Unlike Medicare Advantage plans, Medigap plans are all the same no matter from which company you buy a policy.

In fact, CMS publishes this every year in the Medicare and You Manual and states the following:

The benefits in each lettered plan are the same, no matter which insurance company sells it. The premium amount is the only difference between policies with the same plan letter sold by different companies.

This means you’ll get the same coverage if you buy a Plan G policy from Cigna or buy a Plan G policy from Aetna, or any other provider.

If you live in Wisconsin, Minnesota, or Massachusetts, you may not have access to Plan G. Medigap policies are standardized differently in these states:

- If you live in Massachusetts

- If you live in Minnesota

- If you live in Wisconsin

The Cost of Plan G

Even though by law, all Plan G policies must cover the same thing, premium costs can vary. These costs will depend on the carrier, zip code, age, gender, and whether or not you smoke.

Plans are typically priced between $80 and $170 per month and are in addition to your Part B premium. If you go with a high deductible Plan G, your premiums will be less.

Like other Medigap policies, a Plan G policy only covers one person. If you and your spouse both want Plan G coverage, you will both need to buy policies.

You’ll need to work with a licensed agent to plug in all the variables and come up with the best and most affordable plan for your particular needs.

Also, keep in mind that if you don’t enroll during your Initial Enrollment Period, there’s no guarantee you’ll get coverage, and if you do, it could cost you more. If you can get coverage and you have a pre-existing condition, you may have to wait for up to an additional six months for coverage to kick in.

One other important thing to know is that if you buy a Plan G policy and drop it, there’s no guarantee you be able to re-enroll.

Medigap Plan G vs. other Medicare Supplement plans

Here’s how Plan G stacks up against other Medigap plans.

Is Medicare Plan G better than Plan F?

Plan G and Plan F are almost identical to each other.

The only difference is that Plan F covers the Medicare Part B deductible. However, Plan C and Plan F are being phased out, and only people enrolled in those two plans before December 31, 2019, get to keep those plans.

The good news is that Plan G is cheaper than Plan F with almost identical benefits, so many beneficiaries prefer Plan G anyway because it is viewed as a better overall value.

For example, you will need to pay the Part B deductible, but with lower monthly premiums for Plan G, you could save $400 or more each year.

The standard Part B deductible in 2020 is $198, but Medicare also introduced a high deductible Plan G with an annual deductible of $2,340 in January 2020.

When Can I Get Medicare Supplement Plan G?

The best time to get a Plan G policy is during your Initial Enrollment Period. You are guaranteed coverage for any plan that’s available in your neighborhood, regardless of any existing health conditions.

You can enroll at any other time during the year, but an insurance company can charge you more for existing conditions or deny you coverage outright.

Your best bet is to speak with an agent who will give you complete details.

What you need to know before enrolling in Medigap Plan G

One of the most important aspects of all Medigap plans is that they are guaranteed renewable, even if you develop health problems. You can’t be canceled by an insurance company as long as you pay your premium.

Also, guaranteed issue rights are in play in certain situations. This means an insurance provider must offer you certain Medigap policies when you are not in your Medigap Open Enrollment Period.

If you qualify, a provider must sell you a policy, cover your pre-existing conditions, and can’t charge you more even if you have past or present health problems.

Typically, guaranteed issue rights are available when you lose other health coverage or your existing coverage changes. You also have a trial right if you decide to buy a Medicare Advantage plan and want to change your mind and return to a Medigap policy.

Guaranteed issue rights are federal law. Many states also provide additional Medigap rights.

Plan G policies are not going away per se, but first dollar coverage is, due to deductible coverage no longer being offered for Part B. High Deductible Plan G is also a new change for 2020 as well.

If you have questions about Medigap coverage in your state or to make sure you qualify for all benefits, contact your State Health Insurance Assistance Program (SHIP).

Medicare also published a comprehensive guide to choosing a Medigap policy that may answer several questions as well.

Finding Affordable Medicare Supplement Insurance plans

To buy an affordable Medigap plan, you need to compare policies to see which one best meets your needs. Your best bet is to work with a licensed insurance agent in your area.

You can also use the Medicare.gov website to find a Medigap policy or call your SHIP for information.

An agent will help you compare costs once you decide which plan to buy. Keep in mind all coverage by letter is the same, but premium costs can be different.

When you buy a policy, the insurance company must give you a plain-language summary of your benefits. Read it and make sure you understand everything. If you don’t, be sure to ask questions.

Companies that offer Plan G

You have several choices when deciding which Plan G to buy. Price is a significant factor. And there are also several A, and B rated companies that offer policies.

Overall, consider that companies with higher ratings have plans with higher ratings. Outstanding customer service is an essential factor.

Top Medicare Supplement Companies in 2025:

- AARP

- Aetna

- Amerigroup

- Cigna

- Humana

- Mutual of Omaha

- WellCare

The top of this Medicare supplement list doesn’t necessarily mean the best rates or the best claims ratio. The list is written in alphabetical order from top to bottom.

Call us at (833)-567-3163