The Best Dental Plans for Seniors on Medicare

Why Seniors Need a Dental Insurance Plan

According to the National Institute of Dental and Craniofacial Research:

- Most people over the age of 65 are missing an average of 13 teeth. In fact, an estimated 27% have no remaining teeth at all

- Over 23 percent have gone at least five years since their last dental visit

- 16 percent of people over 65 consider their oral health as “poor”

Another eye-opening fact is that nearly two-thirds of the Medicare population, or about 37 million out of 60 million beneficiaries, have no dental coverage at all.

Although seniors generally have a lot of other health conditions to be concerned about, researchers have found links between poor oral health and health problems such as cardiovascular disease, dementia, respiratory infections, diabetes, cancer, and more.

Even arthritis can cause poor oral health habits. If you have arthritis in your hands and fingers, you may have trouble brushing and flossing your teeth every day.

You need to be aware of the various dental health problems you face so that you can actively resolve them before they lead to further complications. Some of those common problems include:

Darkened Teeth. When enamel wears away, dark dentin underneath is exposed, leading to darkened teeth. This bone-like tissue is affected by your diet and medications, and drinking coffee, tea, and soda can contribute to this condition.

Dry Mouth. As you get older, you may start taking more medications, which can lead to a dry mouth. Saliva protects our teeth from decay and bacteria, so when there is not enough of it, a dry mouth can lead to viruses and fungi forming in your mouth. Water is crucial for dental hygiene, which is why you should try to drink a minimum of 8 glasses a day.

Root Decay. If you don’t take care of your mouth through regular brushing, flossing, and check-ups, your gums can recede. When this happens, your roots are exposed.

Tooth roots are covered by cementum, which is responsible for anchoring the tooth to the jawbone. Cementum does not protect your teeth the same way as enamel, so when this part of a tooth is exposed, your risk of tooth decay increases.

Gum Disease. Gum disease develops when there is an excess of plaque caused by small pieces of food left in your teeth. It can cause bleeding and is often the result of a lack of brushing or flossing. Gum disease is higher in people who smoke, have bad diets, or wear poor-fitting dentures.

Gum disease is the leading cause of tooth loss among seniors.

Oral Cancer. Oral cancer can appear on your lips, cheek lining, gums, tongue, and top of your mouth. Symptoms include a sore that won’t go away, red or white patches, numbness, and difficulty chewing, swallowing, or speaking.

A healthy diet and avoiding excess sun exposure to your mouth and lips can help prevent or at least limit oral cancer symptoms.

Denture-induced stomatitis. This can be caused by poorly fitting dentures, poor dental hygiene, or a buildup of the fungus Candida albicans. These all can result in the inflammation of tissues underlying your dentures. Drugs or diseases that affect the immune system can also result in an overgrowth of this fungus as well.

You’ve heard it many times before, but the best way to prevent poor oral health is to practice good oral hygiene. Just a few minutes each day can help prevent or slow the onset of many of these problems. You’ve heard them all before, but as a reminder, you should:

- Brush your teeth twice per day with fluoride toothpaste

- Floss once per day

- Use an electric toothbrush

- Use mouthwash after brushing your teeth

- If you wear dentures, clean them daily

- Visit your dentist regularly

- Drink plenty of water

Is There a Dental Plan for Medicare Patients?

If you qualify for Medicare, you’re covered for a lot of health-related issues. Unfortunately, Medicare Part A and B cover very few dental-related costs.

Part A may cover oral examinations if they are related to another hospital stay.

Medicare Part B covers jaw diseases, oral cancer, face tumors, or face fracture-related procedures and infections caused by dental procedures.

Parts A and B do not cover important services such as routine exams or cleanings that will help detect and prevent significant dental problems. Dentures, denture care, dental plates, or other dental devices, supplies, fillings, or having teeth pulled are not covered as well.

As you can see, the lack of coverage for dental services in Original Medicare is problematic.

To make sure you’re covered, you’ll need to look at other forms of coverage, such as a Medicare Part C (as known as Medicare Advantage) plan or a stand-alone dental insurance policy.

Additional Dental Coverage Options for Seniors

Even though Original Medicare does not cover the majority of dental services, there are a couple of options for Medicare supplemental dental insurance plans or stand-alone plans to help you save money. These plans may also include vision coverage as part of an overall package, or as a stand-alone option.

For example, Humana offers optional supplemental dental benefits to enhance Medicare coverage. You can add these benefits to a Humana Medicare Supplement or use to supplement existing Humana Medicare Advantage plan benefits when you enroll or at any time while you’ve got a policy in force.

Humana allows you to choose from several different policies:

- MyOption Dental High PPO

- MyOption Enhanced Dental PPO

- MyOption Enhanced Dental HMO

- MyOption Vision

- MyOption Plus

- MyOption Platinum Dental

- MyOption Fitness

Not all providers offer all plans throughout the entire country. For example, you have several choices if you’re looking for dental insurance in Florida or New York, but probably a lot fewer options if you want coverage, and you live in Wyoming or South Dakota.

You may discover that the Medicare Advantage plans offered in your area don’t provide adequate dental benefits or don’t provide coverage at all. This is part of the due diligence you’ll need to look into when seeking dental coverage.

If you fall into this category, you will probably be able to find coverage through a private dental insurance plan that does not contract with Medicare.

Many stand-alone dental insurance plans cover 100 percent of routine and preventive care, such as cleanings and exams. You will probably need to pay a monthly premium and satisfy deductibles and copays, but you may save money overall because you won’t have as many out-of-pocket costs.

For example, dental insurance plans may cover 70-80 percent of treatments, such as fillings or extractions. You may pay 50 percent of major procedures, such as crowns or bridges.

What does Medicare Advantage Dental Cover?

There is no pat answer because every Medicare Advantage Dental policy will offer different benefits. However, any Medicare Advantage provider must provide at least the same level of benefits as Original Medicare, and they can provide additional coverage as well.

These coverages will vary from plan to plan.

Medicare Advantage plans may include dental coverage for services including:

- Cleanings (prophylaxis)

- Dental X-rays

- Diagnostic services

- Endodontics (root canal treatment)

- Extractions

- Oral exams

- Restorative services such as fillings

- Periodontics (gum disease and oral inflammation treatment)

- Extractions

- Prosthodontics (crowns, bridges, dental implants, and dentures)

All of these services are often subject to maximum benefit limits which vary by company.

What Dental Services Are Covered Under Original Medicare?

Dental benefits are minimal under Parts A and B, but there are still some benefits that are exceptions to what is known as the Medicare Dental Exclusion Rule.

The basic principle is that if a dental procedure is required before or after certain medical procedures, Medicare will cover that dental procedure, including:

- An oral exam in the hospital before a kidney transplant

- An oral exam in a rural clinic or Federally Qualified Health Care Center before a heart valve replacement

- Dental services required for the radiation treatment of certain diseases of the jaw, such as oral cancer

- Ridge construction (reconstruction of part of the jaw) performed when a facial tumor is removed

- Surgery to treat jaw or facial fractures

- Dental splints as well as wiring required after jaw surgery

- Medicare also covers some dental-related hospitalizations, including observation during a dental procedure, because you have a health-threatening condition.

In these cases, Medicare will cover the cost of services done by the hospital (room and board, anesthesia, x-rays). It will not cover the professional service fees for the dentist or other physicians (radiologists, anesthesiologists).

Those service fees become the responsibility of the patient.

Senior Dental Insurance Costs

Trying to provide you with a blanket statement of how much dental insurance costs is impossible. There are simply too many factors to consider to give you an accurate number for your specific situation.

Still, you should be aware of some of the financial issues you’ll face when you get dental coverage.

Medicare Advantage dental services typically come with a co-insurance or co-pay, although some areas have plans with zero-dollar premiums.

Co-insurance is usually a percentage. For example, you will owe 20 percent of the covered service costs. If it costs $400 to have a tooth filled, you’ll pay $80, or 20% of that cost.

A co-pay is a set dollar amount that you will owe for services, such as $20 for X-rays, an exam, and cleaning. You will generally pay a co-payment when you visit your dental provider. With coinsurance, your provider will be billed, and you will be sent an invoice for the remaining amount.

Keep in mind that while certain basic minimums must be met, every policy will carry different coverages, co-pays, and co-insurance amounts. All of these will factor into the monthly premium you’ll pay.

For example, Cigna offers a plan in Florida for $149.95 a year, while Carington POS Dental Plan only costs $114.95. Before you jump on the lower-cost plan, make sure of what’s covered and to what amount.

Also, be sure to look at annual limits, among other things, when comparing costs.

You may also decide to go the route of a dental savings plan. This is much like a Costco approach. You pay a monthly or annual fee, and you get discounts from certain groups of dentists.

This type of savings plan is not insurance, but it is a way to save money on dental care.

The Best Dental Plans for Seniors in 2020

The best dental plan for seniors is the dental plan that is best for you. That said, there are some standout policies and providers worth investigating.

Seniorliving.org is one source that has compiled a list of the best dental plans for seniors in 2020. Humana is ranked as the best overall, while Cigna offers the best coverage in terms of actual benefits, and Guardian has the best value.

To see the complete list and rankings, go here.

ConsumersAdvocate.org also has a list of the 10 best dental insurance companies of 2020. Guardian tops the list at #1. To see where others rank, go here.

Another site offering up reviews is The Senior List. Aetna earns the top spot with the best overall plans. AARP offers the best senior discounts. Others are ranked according to other criteria. Go here to see the rest of the reviews.

Benzinga Money rates Delta Dental the highest while Humana is the most affordable. To see more, go here.

Dental Coverage Under Medicaid and Medigap

Medicaid is a partnership between the Federal government and state governments to provide healthcare coverage for almost 5 million low-income seniors and a large number of individuals who aren’t currently eligible for Medicare.

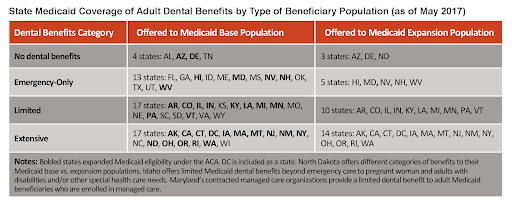

While states are required to provide dental benefits to children covered under Medicaid, no such provision exists for adults. States have the option to choose whether or not they will provide dental benefits for adults.

States are also free to decide what level of dental benefit coverage they will provide.

Most states provide emergency dental services. However, four states provide no dental coverage at all, while only 17 states provide comprehensive dental coverage.

You will need to contact your state’s Medicaid office to determine if you’re eligible for dental benefits under Medicaid and to what extent.

You can also go to Medicaid.gov for official information on Medicaid dental coverage.

Medigap plans can only supplement Original Part A and B Medicare benefits. Since Original Medicare doesn’t provide routine dental care, Medigap plans also do not cover dental benefits.

If you are currently enrolled in a Medicare supplement or Medigap plan, it’s wise to shop and understand your options for a stand-alone dental insurance plan.

Where to Find Dental Insurance for Seniors

You simply can’t afford to take chances with your dental health. As you grow older, accessing dental services regularly is one of the overall keys to staying healthy for many years to come.

Many seniors and people who are eligible for Medicare may be watching their income, and that’s where Medicare Plan Finder can help. Your experienced agent will help you find a Medicare Advantage plan that covers your necessary medical expenses, including dental coverage.

When you enlist Medicare Plan Finder’s help, you get an expert in Medicare on your side who can help you save money by weighing the pros and cons of the plans in your area. You’ll also get the help you need to decide if a Medicare Advantage plan with dental coverage, a stand-alone dental plan, or if a dental savings plan is right for you.

Call 1-855-783-1189 (TTY 711) or contact us here to learn more today.

An updated post on December 12, 2020.