How to Get Help Paying Medicare Premiums

September 17, 2019The National Council on Aging (NCOA) says that over 25 million Americans age 60 and older “struggle with rising … healthcare bills.” Thankfully, federal and state governments have assistance programs for people who need help paying Medicare premiums and other costs.

What Are Medicare Premiums?

A premium is an amount you pay every month for insurance coverage. Original Medicare is health insurance that provides coverage for specific services.

You can qualify for Medicare either by turning 65, or sooner if you have ALS, ESRD, or you’ve received SSDI for at least 25 months.

Medicare premiums can seem expensive, especially if you have a limited income. For example, many people don’t have to pay a Medicare Part A (hospital insurance) premium, but they might still have to pay the Medicare Part B (medical insurance) monthly premium (standard is $144.60 in 2020).

You might not have to pay a Part A premium if you or your spouse has worked 40 or more quarters and paid Medicare taxes or you otherwise qualify for premium-free Part A. You could pay up to $458 per month in 2020 if you don’t qualify for premium-free Part A.

On top of that, Original Medicare (Part A and Part B) doesn’t cover everything. If you want extra benefits such as prescription drug coverage, you’ll need to enroll in Medicare Part D, or a Medicare Advantage plan with a prescription drug benefit. Either option may come with a separate premium. Luckily, you may be able to receive help paying Medicare premiums.

What Should I Do If I Need Help Paying My Medicare Premiums?

If you need help paying Medicare premiums, you can apply for several assistance programs called Medicare Savings Programs (MSPs). You may need to provide certain legal documents such as a Social Security card, Medicare Card, and proof of income and address to apply. You may even qualify for several different benefit programs at the same time!

Medicare Savings Programs

There are four types of Medicare Savings Programs (MSP). Each one has its own set of income limits. Your state may have different limits for annual income, too.

In 2019, the total asset limits for most MSPs are $7,730 for an individual, and $11,600 for a couple. These limits are only federal guidelines. Your state may have different limits.

- Qualified Medicare Beneficiary Program (QMB). Can help pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. An individual may qualify in 2019 with an income up to $1,061 per month or $1,430 per month for a couple. If you qualify for QMB, you may also be eligible for Extra Help (LIS) paying for Part D prescription coverage.

- Specified Low Income Medicare Beneficiary Program (SLMB). Can help pay premiums for Part B. A single person may qualify in 2019 with an income up to $1,269 per month or $1,711 per month for a couple. If you qualify as a SLMB, you’re may be eligible for LIS paying for Part D prescription coverage.

- Qualified Individual Program (QI). Can help pay premiums for Part B. An individual may qualify in 2019 with an income of up to $1,426 per month or $1,923 per month for a couple. Note: QI enrollments are limited, and they’re granted on a first-come, first-served basis. If you qualify for QI, you may also qualify for Extra Help paying for Part D prescription coverage.

- Qualified Disabled and Working Individuals Program (QDWI). Can help to pay Part A premiums. This MSP is for disabled people who lost their premium-free Medicare Part A when they went back to work. The income limits for QDWI are $4,249 per month for an individual, and $5,722 for a couple in 2019. The asset limit is $4,000 for an individual and $6,000 for a couple.

Medicare Savings Program Application and Eligibility

The best way to find out if you qualify for MSPs is to apply and let your state determine eligibility. However, Benefits.gov has a tool that uses multiple choice questions to find out if you may be eligible.*

*The tool is only to see if you MAY be eligible. For more information about your eligibility, contact your State Health Insurance Assistance Program (SHIP).

Your state’s Medicaid office can provide information about how to apply and where to send your application.

After you apply, you should receive a “Notice of Action” within 45 days detailing what programs you qualify for, and you should be automatically enrolled in the program that most aligns with your qualifications.

Low Income Subsidy (LIS)

Low Income Subsidy (LIS) or Extra Help is a federally-funded program that helps Medicare beneficiaries save on prescription drugs. LIS can help cover your Part D premium, deductibles, coinsurance, and copays.

The program can provide huge savings! For example, you won’t pay more than $3.40 for generic drugs or $8.50 for brand-name drugs in 2019 according to the Social Security Administration (SSA).

To qualify for LIS, you must have a monthly income of less than $1,405 for an individual or less than $1902 for a couple in 2019. You must also

- Have Original Medicare (Part A and Part B) coverage

- Have prescription drug coverage (either a Medicare Part D plan or a Medicare Advantage plan with prescription drug benefits)

- Have American citizenship

- Not have savings, investments, and real estate valuing more than $28,150 if you are married or $14,100 if you are single

You may also qualify for Extra Help if you have Supplemental Security Income (SSI) or if you have both Medicare and Medicaid insurance. If you think you meet the eligibility requirements, click here to apply for LIS or ask your insurance agent to help you.

Medicaid and Medicare Dual Eligibility

If you qualify for both Medicare and Medicaid, you may be eligible for a specific type of Medicare Advantage plan plan called a Dual Special Needs Plan (DSNP). These plans can cover most Medicare costs including premiums for enrollees.

If you qualify for a DSNP, you may also qualify for a Special Enrollment Period (SEP), which can give you the freedom to make one change per quarter to your plan*. This is a huge cost-saving benefit to DSNP enrollees because it means you can enroll in a plan that best suits your needs.

For example, if your doctor stops accepting your insurance plan, but he accepts another DSNP in your area, you can switch plans to stay with your doctor. You won’t have to enroll in a different plan with a potentially higher premium.

*For the first three quarters of the year as long as you qualify for both Medicare and Medicaid.

How to Save Money on Premiums With Private Medicare Insurance Plans

Some people may not qualify for Medicaid, MSPs or LIS. However, you may still be able to save some money. If you have Original Medicare, you can enroll in private plans such as Medicare Advantage or Medicare Supplements. Note: You must choose one because you cannot be enrolled in both at the same time.

Medicare Advantage Plans

Medicare Advantage (MA) plans help cover medical services. These plans can offer additional benefits such as prescription drugs, vision, hearing, dental, and even fitness classes! Most MA plans have monthly premiums (the average is $23 in 2019) and some MA plans have $0 monthly premiums*.

*You must continue to pay the Part B premium in addition to a Medicare Advantage premium.

If you stick with Original Medicare, you could end up spending more money in premiums and other monthly dues. For example, if you have a gym membership, you likely have to pay dues. That’s one expense. If you have private dental insurance to cover routine cleanings, that’s another. Add vision insurance to that, and that’s three monthly expenses.

Alternatively, you might be eligible for a Medicare Advantage plan that includes dental, vision, and fitness supplemental benefits!

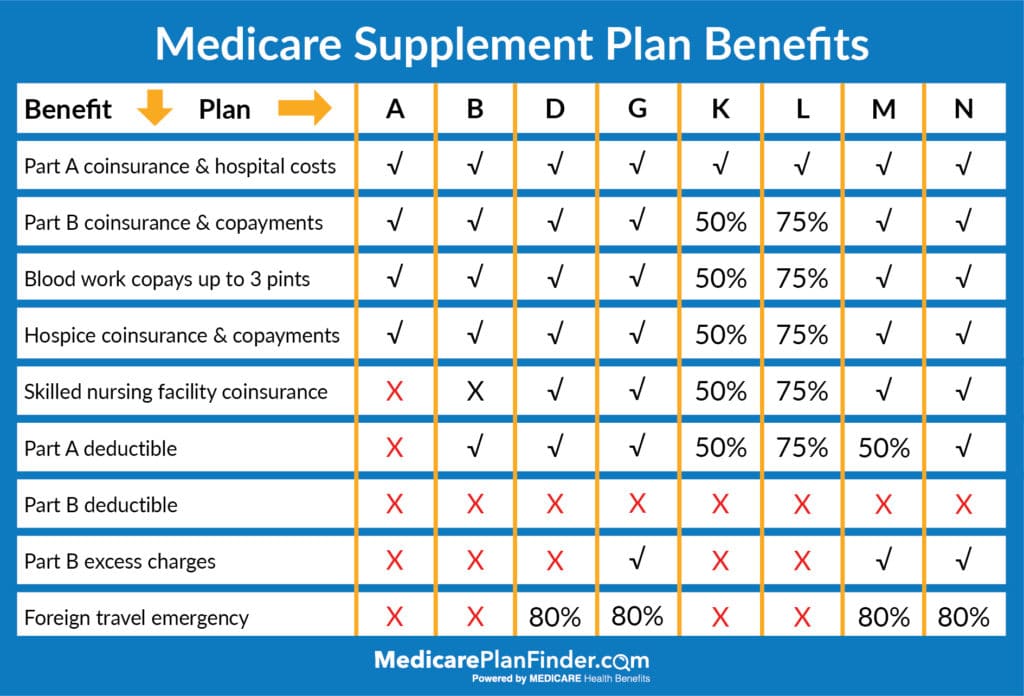

Medicare Supplement Plans

Medicare Supplement (Medigap) plans help pay for financial items such as coinsurance. In 2020, there eight different Medigap plans that offer different levels of coverage. Basically, the more services the plan covers, the higher the premium. Depending on your needs, you can save money on premiums by selecting a plan that covers fewer services.

Find Help Paying Medicare Premiums

If you’re struggling to pay your monthly Medicare premiums, a licensed agent with Medicare Plan Finder may be able to help. Our agents are highly trained and can help you find a plan that suits your budget needs. To set up a no-cost, no-obligation appointment call 844-431-1832 or contact us here to learn more today.