Medicare Power of Attorney 101

If you are a caregiver for your parent or loved one, you may not realize that you’re unable to make medical and financial decisions on their behalf until it’s too late.

You don’t want to get caught in a tough situation and feel powerless. Fortunately, a power of attorney can help, but it’s crucial you understand the different types of POAs and common misconceptions.

Types of Power of Attorney

A lot of people don’t understand that a power of attorney is one of the most powerful legal documents you can obtain.

It allows the “principal” (the person granting the power) to select an “agent” (the person receiving the power) to be in charge of a wide range of certain medical and financial matters. Depending on the type of POA granted, you may be given the ability to:

- Collect Social Security benefits on the principal’s behalf

- Use the principal’s money to pay various bills

- File the principal’s taxes

- Make financial decisions on their behalf

- Buy, sell, or manage the principal’s property

- Give gifts or donations on behalf of the principal

- Make decisions regarding the principal’s health

Your loved one can appoint several people to be a POA. However, multiple agents can make the decision-making process sloppy. The best bet is to designate people in the areas they have experience in or where they feel comfortable holding responsibility.

Help your parent or loved one make the best decision by educating them on the different types of POA:

Non-Durable: This type of POA is set for a specific amount of time and is generally used for one particular transaction. Once the transaction is over, the POA ceases.

Durable: A durable POA can be used to manage all of the principal’s affairs. Durable POAs are effective immediately and only expire when the principal passes away.

Special or Limited: This type of POA is typically used on a limited basis for one-time financial decisions, like a sale of a particular property. This is most commonly used when the principal cannot complete the transaction due to other commitments or illnesses. The POA has no other power apart from the one-time financial transaction.

Medical: A medical POA has authority on all healthcare decisions if the principal becomes incapacitated. This generally takes effect upon approval of a presiding physician. It’s important to note that you would not be able to make any health decisions if they have the mental and physical capacity to make decisions on their own.

Springing: This type of POA will become effective in the future, only if a specific event occurs. This event can include incapacitation or a triggering event, like leaving the country. This POA can be durable or non-durable and can encompass any affair. This allows the principal to create a POA that is specific to their needs.

What is a Medicare Power of Attorney?

Technically, a Medicare Power of Attorney should be appropriately referred to as a Durable Power of Attorney as it is the only POA that allows you to make health decisions alongside your parent before they become incapacitated.

Medical POA only grants you power after your parent becomes incapacitated. However, a Durable POA gives the power to help your parents make decisions regarding Medicare Advantage, Medicare Supplements, Part D plans, and more. If you are looking to become a “Medicare Power of Attorney,” you will need to explore the Durable Power of Attorney instead.

It’s crucial that you understand that a power of attorney document doesn’t make you the sole decision maker. You and your parent would have the same legal weight in the decision-making process. Plus, your parent can revoke the POA at any time.

Does Medicare Recognize Power of Attorney?

Yes! When it comes to Medicare, you need legal authorization anytime you are acting on behalf of your parent. This means, unless you have the appropriate POA, Medicare will not allow you to make any decisions or even discuss their healthcare plans. However, a Durable Power of Attorney gives you equal power when making your parent’s healthcare decisions.

This means unless you have Durable Power of Attorney, Medicare will not allow your parent to make an appointment with a licensed agent to enroll, change, or switch their plan with your presence or consent.

How to Get Power of Attorney for Elderly Parents

When creating a power of attorney, your parent must be mentally competent at the time of signing. As a general rule, you should start these conversations as soon as possible. Once your parent selects an agent and type of POA, they will need to fill out the proper forms and have it authorized by a notary.

There are several POA documents available online, however, it is recommended that you avoid downloading any forms and that you work directly with an elder law attorney or courthouse.

Once the documents are finalized, you and your parent should make several copies and store them in a safe and secure location.

Power of Attorney Medicare Enrollment

Once you have durable POA, fill out this CMS medical release form provided by CMS and attach your Power of Attorney document. The form will allow you to view your parent’s medical information.

Your durable POA document will allow you to meet with an agent and make decisions on your parent’s behalf including enrolling in a Medicare plan.

Elder Law Attorney Finder

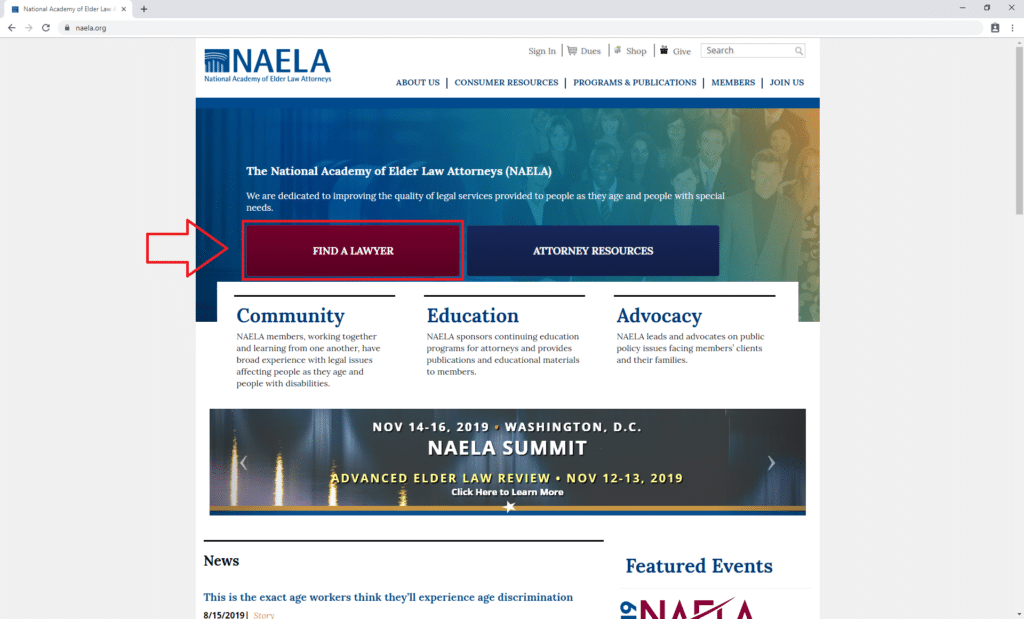

An elder law attorney is a lawyer who focuses on the needs of seniors. Elder law is a broad field that includes Medicare law and power of attorney. If you need a lawyer to help with POA, the National Academy of Elder Law Attorneys (NAELA) is a great place to start. To use NAELA’s attorney finder tool, click here.

That will lead you to NAELA’s homepage. Click “Find a Lawyer.”

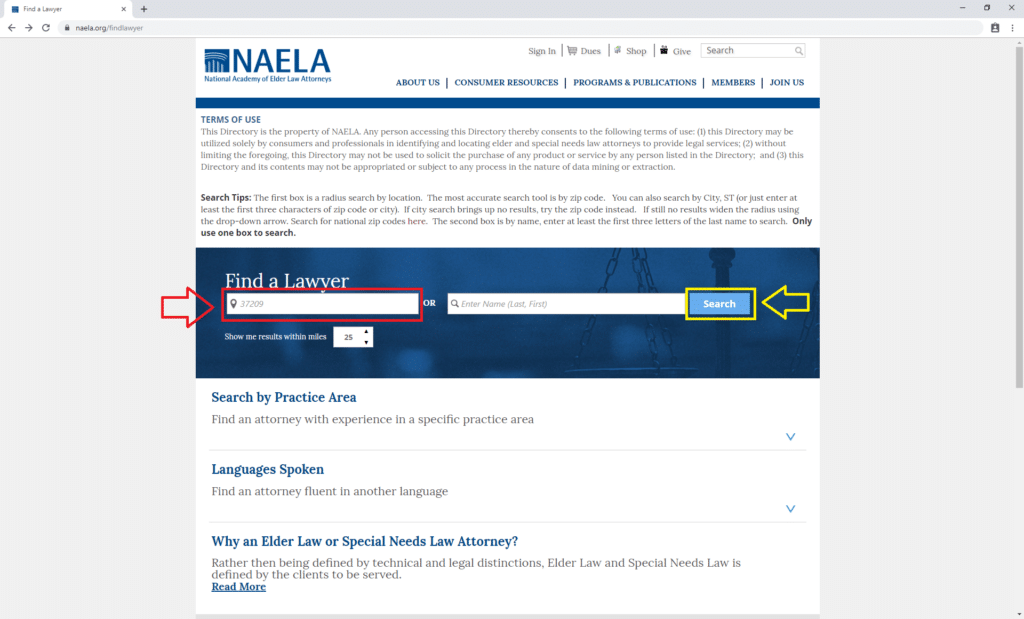

Enter your zip code in the search bar as shown below in red. For our purposes, we’re using 37209, which is the zip code for our corporate headquarters in Nashville, TN. Then click “Search,” shown in yellow.

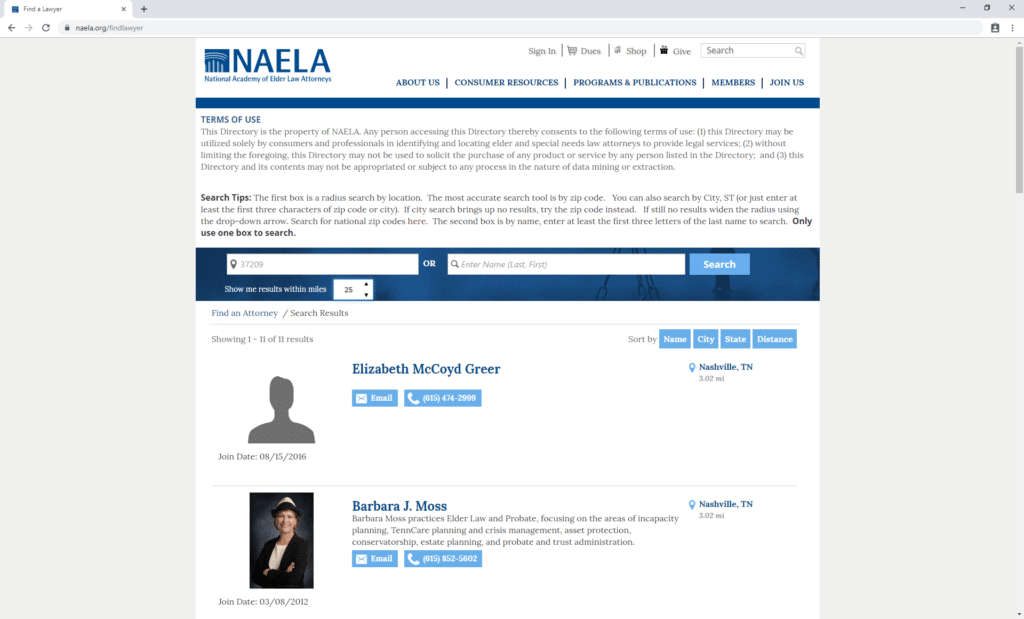

That will lead you to a list of elder law attorneys in your area with contact info. You may have to call more than one to find a good fit.

Power of Attorney for Elderly Parent With Dementia

If your loved one is starting to develop Alzheimer’s or dementia, you should try to have the conversation about a POA immediately. In order for your parent to sign a POA, they need to be mentally competent and understand what they are signing.

If the Alzheimer’s or dementia worsens, your parent may be unable to sign and you cannot be granted a POA. If this happens, you can explore becoming a conservator. Conservators act similarly to a POA. You will still be able to make certain medical and financial decisions, but there will be a costly court procedure.

How to Get Power of Attorney for Parent in Hospital

If your parent is sick in the hospital, they can still sign a power of attorney form. You will just need to bring the document to the hospital. A notary will also need to meet you at the hospital if your parent is unable to leave.

Some facilities have on-staff notaries. Once the document is signed, the process is the same as if they weren’t in the hospital. There should be several copies made and stored in a safe place.

Common POA Misconceptions

Misconception: POAs extend after the principal’s death.

Truth: All POAs expire when the principal passes away.

Misconception: If a principal signs a POA, they forfeit their independence and rights to make their own decisions.

Truth: The scope of POAs can be as broad or as narrow as the principal wants. Many times, principals can require a physician statement to attest if they are incapable of making their own decisions.

Misconception: POAs are the same in every state.

Truth: POAs can vary across different states. Be sure to research the type of POA and state guidelines before signing.

Misconception: POAs can be found online.

Truth: You can find POA documents online, but your best bet is to work directly with a lawyer or courthouse to guarantee authenticity.

Misconception: POAs take away your parent’s decision making power.

Truth: A POA document does not remove your parent’s ability to make decisions on their own, it just authorizes someone else to act under the limitations that they have set.

Medicare POA and How to Get Coverage for Your Loved One

If you are a Medicare power of attorney for your parent, you hold some responsibility in ensuring they have the best health coverage for their unique needs and budget.

At Medicare Plan Finder, we make sure both you and your parent are educated in plan options including Medicare Advantage, Medicare Supplements, and Part D plans. If you are interested in arranging a no-cost, no-obligation appointment for you and your parent, click here or give us a call at 844-431-1832.

This post was originally published on May 31, 2019, and updated on August 16, 2019.