The Ultimate Guide to Medigap Plan D

August 20, 2019Medicare Supplements, also known as Medigap plans, add financial benefits that work alongside your Original Medicare. These benefits include help paying your copayments, coinsurance, and deductibles. Enrollment has increased every year since 2010, and there are more than 13 million beneficiaries taking advantage of Medigap plans in 2019.

There are more than ten types of plans (A, B, C, D, F, G, K, L, M, and N), that offer a wide range of coverage at different costs. Many plans are guaranteed renewable life which means you shouldn’t be dropped if a new health condition develops (as long as you pay your monthly premium on time). If you’re looking for financial benefits to supplement your Original Medicare coverage, Medigap Plan D may be the plan for you.

Medicare Supplement Plan D vs. Part D

Medicare Supplement Plan D can be easily confused with Medicare Part D. Medicare Supplement Plan D, is one of the ten types of Medigap plans, while Medicare Part D is prescription drug coverage.

Original Medicare (Part A and Part B) do not cover prescription drugs. Part D was created in 2006 and has since allowed beneficiaries to purchase prescription drug plans alongside Original Medicare to cut down on out-of-pocket drug costs. To learn more about Medicare Part D, click here.

Do You Need Medicare Part D If You Have Supplemental Insurance?

You are not required to enroll in a Part D plan whatsoever. However, once you are enrolled in Part A and B, you should consider enrolling in some type of prescription drug coverage to avoid a late-enrollment penalty down the road. Some Medicare Supplement plans cover prescription drug coverage, but this is rare.

You can get prescription drug coverage through some Medicare Advantage plans or a stand-alone Part D plan. You can be enrolled in a Medicare Supplement plan and Part D plan at the same time, however, you cannot be enrolled in a Medicare Supplement and Medicare Advantage plan at the same time.

If you prefer health benefits like dental, vision, or hearing coverage, or even group fitness classes like SilverSneakers®, you may be better suited for a Medicare Advantage plan. Your best bet is to talk with a licensed agent who can explain plan and benefit details that are available in your area. Fill out this form or give us a call at 844-431-1832.

What Does Medigap Plan D Cover?

Medigap Plan D covers all of the gaps from Original Medicare except for the Part B deductible and Part B excess charges. More specifically, Plan D includes the following:

- Part A coinsurance and hospital costs

- Part B coinsurance and copayments

- Blood work copays up to three pints

- Hospice coinsurance and copayments

- Skilled nursing facility coinsurance

- Part A deductible

- Foreign travel emergency

Medigap Plan D Costs

If you enroll in Medigap Plan D, you will be responsible for a monthly premium, your Part B deductible, and any Part B excess charges. The Part B deductible in 2019 is $185. Part B excess charges are up to 15% of what Medicare paid for a product or service. You are only responsible for the excess charges if your doctor does not accept Medicare assignment rates.

Medigap plans generally provide the same coverage no matter who you enroll with, but they have different prices. There is no reason to overpay for a plan when there may be a cheaper plan with identical coverage.

The costs can also vary based on carrier, zip code, age, gender, and tobacco. A licensed agent can show you all of the available plans in your area and make sure you do not overpay. Fill out this form or give us a call at 844-431-1832.

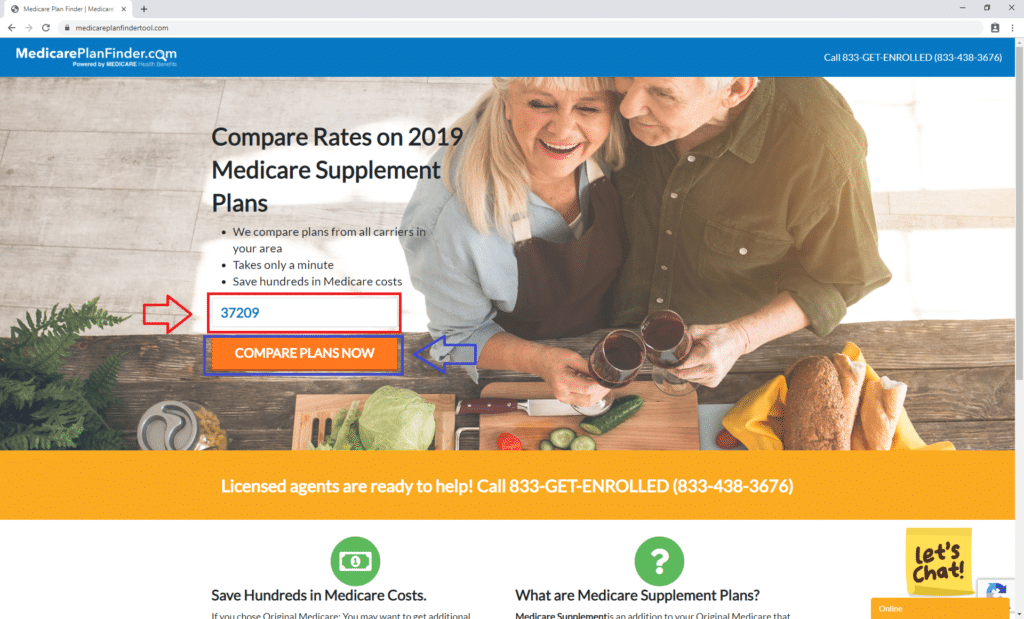

Use Our Medigap Plan Finder Tool to Compare Rates

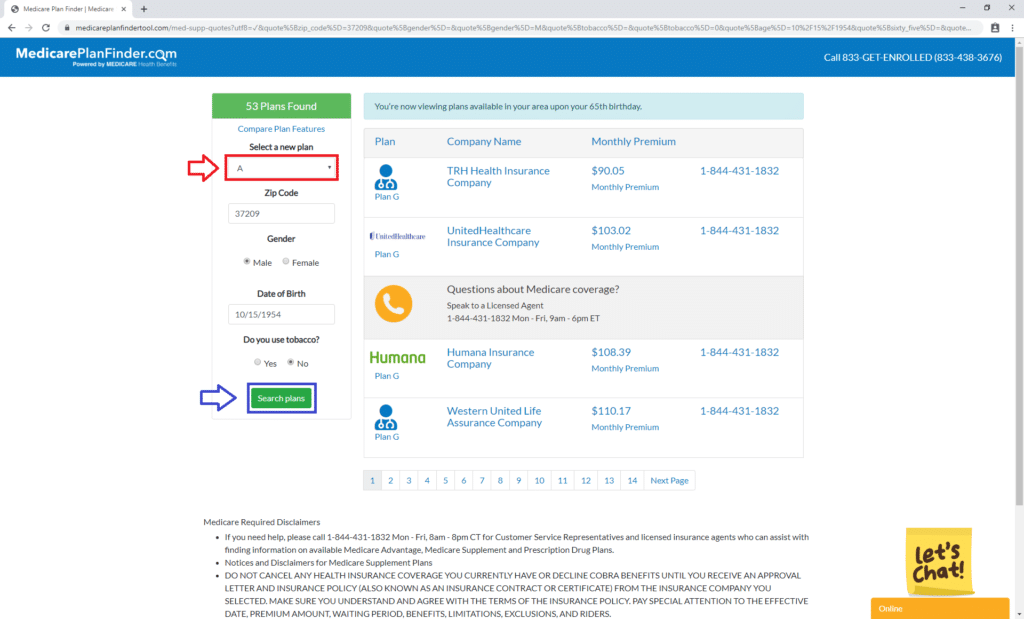

Medicare Plan Finder has a tool to help you find Medicare Supplement Plan D options in your area. To get started, click here. Step one is to enter your zip code so you can find local plans. We used 37209, which is the zip code for our corporate headquarters in Nashville, TN.

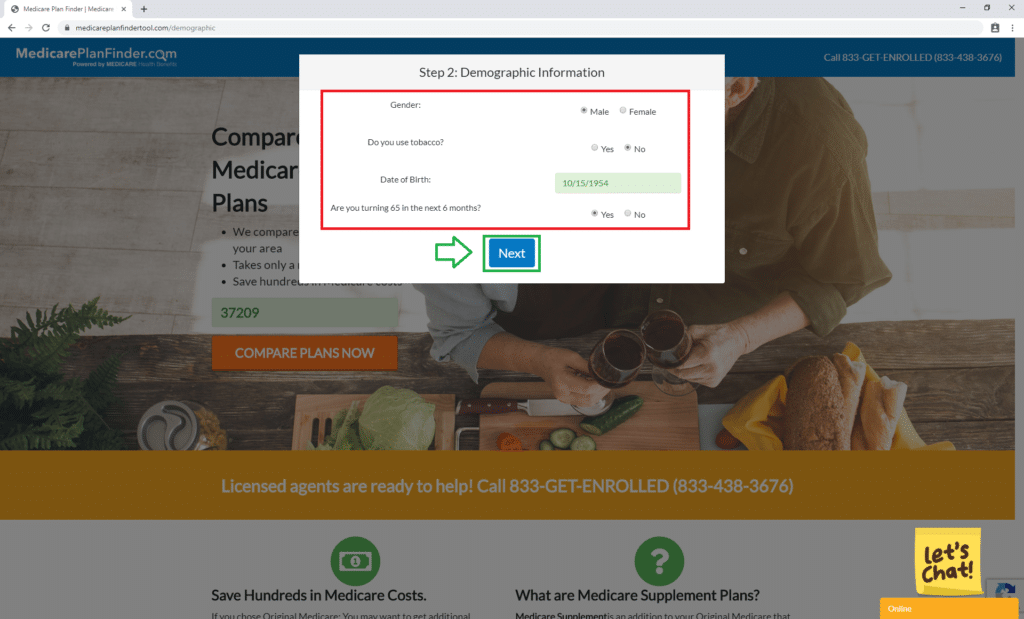

Then answer the questions in the red box. Then click “Next,” in green.

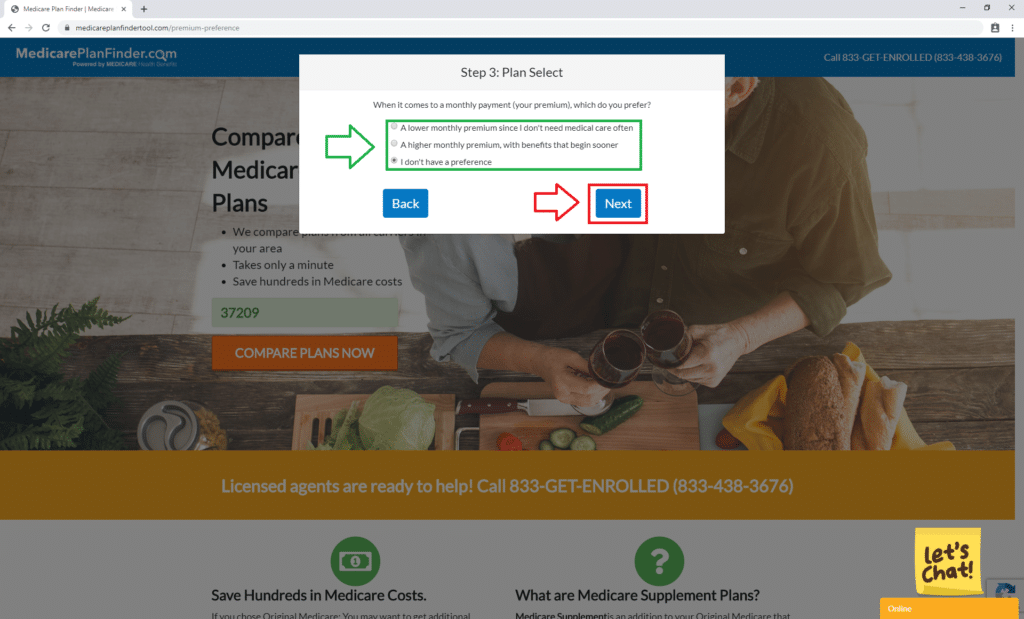

You will then select a plan preference shown in green. We chose “I don’t have a preference,” for demonstration purposes. Then click “Next,” shown in red.

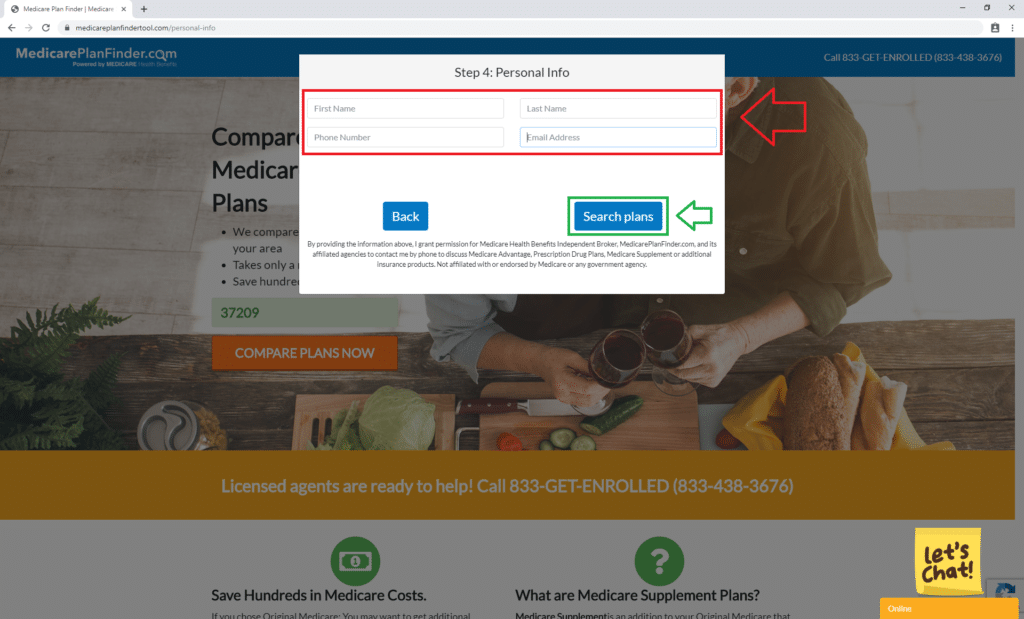

Enter your contact info on the next page in the red box, then click “Search plans,” in green.

You can use the tool to look for any Medicare Supplement plan in your area, but for this blog we’re only going to look for Plan D. To find Medigap Plan D options in your area, use the drop-down menu in red to select “D”.

Plan D Reviews

The top carriers for Medicare Supplement Plan D in 2019 include:

- AARP

- Aetna

- Amerigroup

- Cigna

- Humana

- Mutual of Omaha

- WellCare

Enroll in Medigap Plan D

Did you know you can enroll in Medicare Supplement plans year around? However, carriers can charge you more, or even deny you, if you enroll outside of your initial enrollment period.

Our licensed agents can show you which Medicare Supplement plans are available in your area and help you enroll in a plan that fits your needs and budget.

Why wait? Start saving on your out-of-pocket Medicare costs now! Fill out this form or give us a call at 844-431-1832 to schedule an appointment with a licensed agent. As always, appointments are cost-free to you, and there is never an obligation to enroll.

This post was originally published on May 10, 2019, by Kelsey Davis and updated on August 20, 2019, by Troy Frink.