How Does Medicare Cost Sharing Work?

November 19, 2019Cost sharing is the reason we have any kind of insurance. In many cases, you don’t pay the full amount of medical expenses if you have health insurance. For example, Original Medicare covers 80 percent of approved costs, and you pay 20 percent. It may sound simple, but it can actually be pretty confusing when you take into account deductibles, copays, coinsurance, out-of-pocket maximums, and premiums.

Medicare Cost Sharing Definitions

Medicare cost sharing may seem more complex than other forms of insurance because Medicare has four different parts, and each one covers something different. Two of those parts are public (Parts A and B), and two are private (Parts C and D).

When you add Medicare Supplements to the mix, things may seem even more confusing. For example, you can’t have both a Medicare Part C plan and a Medicare Supplement plan at the same time. Also, if you have a Medicare Part C (Medicare Advantage) plan, you may not need a Part D (prescription drug) plan because some Medicare Advantage plans cover prescription drugs.

Before we go over what cost sharing looks like for each part of Medicare, we’re going to cover some basic Medicare cost-sharing terminology:

- Coinsurance: A percentage of the total cost for medical services. The amount you pay may be different depending on the bill. For example, you may pay 20 percent of the total bill for a doctor visit. If your doctor bills Medicare $100, you’d pay $20.

- Copayment: A set amount that you pay for medical services. For example, you may pay $10 upfront for a doctor’s appointment. If your doctor bills Medicare $100, you’d still pay $10 (though you may receive a larger bill for coinsurance later), depending on what your plan pays.

- Deductible: The amount you pay out-of-pocket each year before insurance coverage “kicks in.”

- Out-of-Pocket Maximum: An overall out-of-pocket spending limit you might have with certain Medicare Advantage plans. Once you reach the maximum, Medicare will cover 100 percent of all approved costs.

- Premium: A set amount you pay every month to keep your coverage.

Medicare Part A Cost Sharing

Medicare Part A is hospital insurance and it covers inpatient procedures, hospice care, and skilled nursing facilities. Many Medicare eligibles don’t pay a monthly premium for Part A. If you don’t meet the “premium-free Part A” requirements, you may pay up to $458 per month in 2020.

The 2020 Part A deductible is $1,408. For inpatient hospital or skilled nursing facility stays, you may pay:

- Days 1-60: $0 coinsurance

- Days 61-90: $352 coinsurance per day in 2020

- Days 91 and beyond: $704 coinsurance per day in 2020. You may be able to use “lifetime reserve days,” which are “extra” days Medicare may cover. You may have up to 60 lifetime reserve days. Once you’ve used your lifetime reserve days, you may be responsible for paying 100 percent of hospital services.

Medicare Part B Cost Sharing

Medicare Part B is medical insurance, and it helps pay for outpatient medical services such as doctor’s appointments, emergency medical transportation, outpatient therapy, and durable medical equipment (DME).

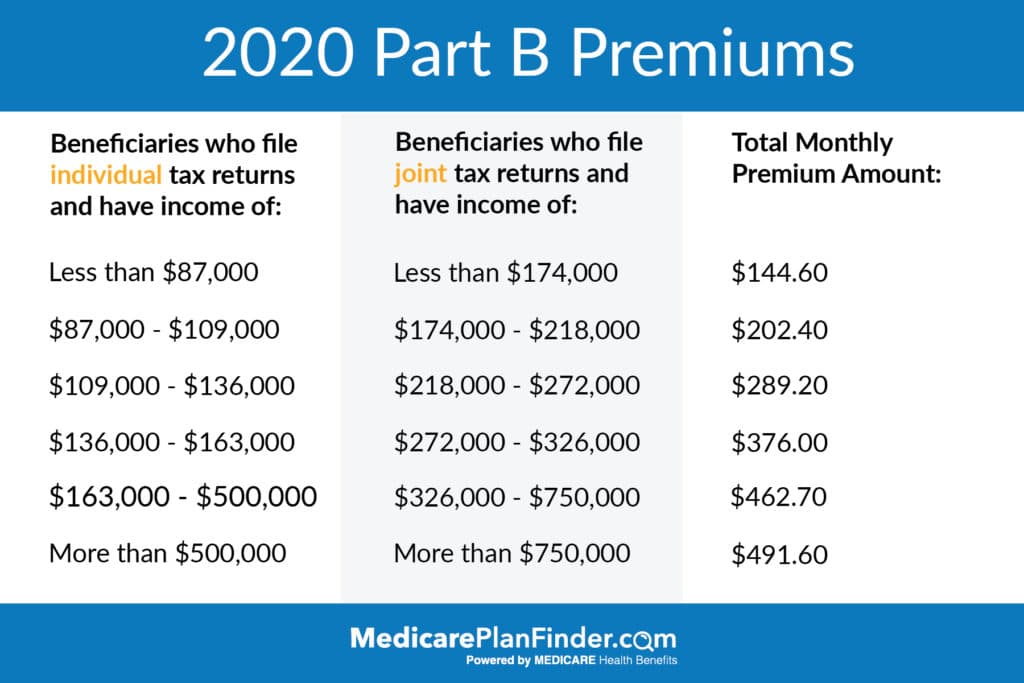

The standard Part B premium is $144.60 in 2020. You may have to pay more depending on your income.

The deductible for Medicare Part B is $198 in 2020. After you meet the deductible, you may pay 20 percent coinsurance of the Medicare-approved total amount.

Medicare Part C Cost Sharing

Medicare Advantage (MA or Part C) are private plans that can cover additional benefits such as prescription drugs, dental, hearing, vision, and fitness classes. You must be enrolled in both Part A and Part B before you can enroll in a MA plan.

Premiums for MA depend on the plan*. They can be as low as $0, but as much as $200. The average premium in 2020 is $23.

Each Medicare Advantage plan may have a different deductible, copay, and/or coinsurance payment. In 2020, the Medicare MOOP (Maximum Out-Of Pocket) spending amount is $6,700**.

Your agent can help you decide if a Medicare Advantage plan is right for you.

If you have a limited income and qualify for both Medicare and Medicaid, you may be eligible for a Dual Special Needs Plan (DSNP), which is a MA plan that may offer low or no-cost premiums, copays and/or coinsurance. You may also be eligible for other help paying Medicare premiums such as Medicare Savings Programs.

*You will still have to pay your Part B premium even if you have a Medicare Advantage plan.

**Medicare MOOP only applies to Original Medicare-covered services. It does not apply to supplemental benefits.

Medicare Part D Cost Sharing

Medicare Part D is prescription drug coverage. You may have to pay a monthly premium, for which the average cost was $33.19 nationwide in 2019.

The 2020 Part D deductible is $435, meaning that Part D plans cannot charge a deductible any higher than that. Many plans may have lower deductibles. Your coverage won’t start until you’ve met your plan’s deductible.

After you meet the deductible, you’ll pay 25 percent of both generic and brand name drug costs. For example, if a prescription drug’s total cost is $40, you’ll pay $10, and your insurance plan will pay the remaining $30.

If your plan requires you to pay a copay or coinsurance, those costs will go toward your TrOOP (True Out-Of Pocket). For example, if your plan requires a $15 copay for a drug, that money will go toward your out-of-pocket limit.

After you pay $6,350, which is the TrOOP threshold, you enter Catastrophic Coverage, and you’ll pay only five percent of your prescription drug costs.

If you have a limited income, you may qualify for LIS (Low Income Subsidy) or Extra Help to help pay Part D premiums and drug copays and/or coinsurance. Extra Help is based on the Federal Poverty Level and your income/assets.

Medicare Supplement Cost Sharing

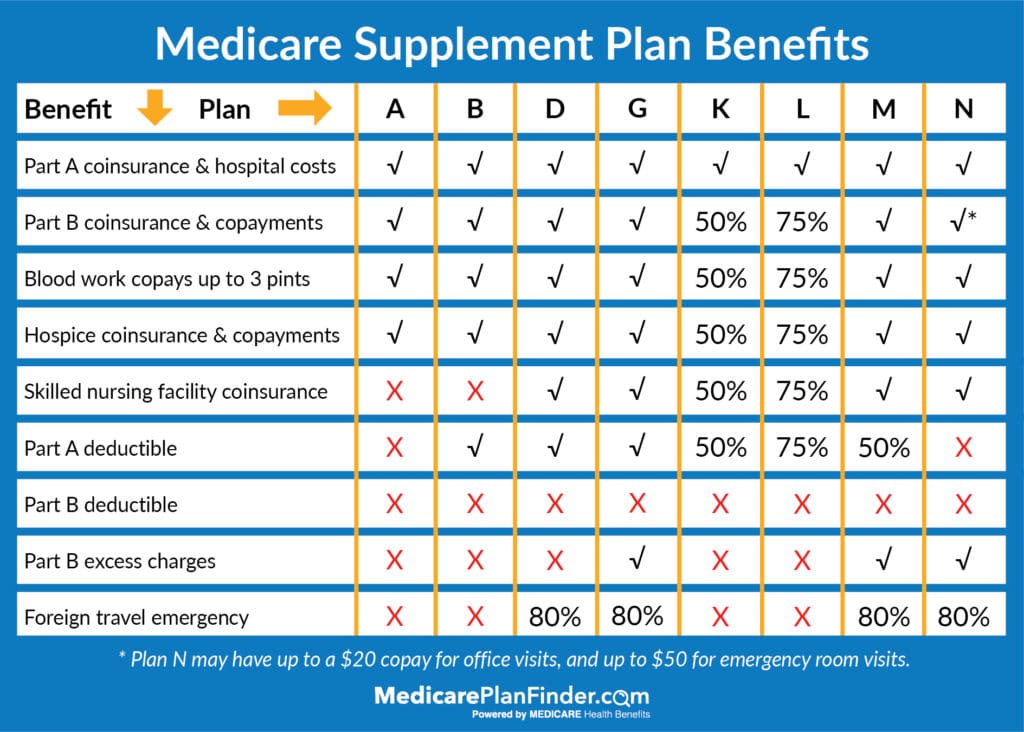

Medicare Supplement (Medigap) plans have a different cost sharing structure than MA plans. Medigap plans have eight standardized coverage levels*. In 2020 there are eight different coverage levels:

Medicare Supplement plans work like this: You pay a monthly premium** and the plan covers the financial items in the chart above. Medigap plans only cover Medicare-approved costs, not additional benefits like MA plans.

Talk to your agent to discuss your needs and whether a Medigap plan is right for you.

*Medigap plans work differently in Massachusetts, Wisconsin, and Minnesota.

**You will still be responsible for paying Part B premiums with a Medicare Supplement plan.

We Can Help You Navigate Medicare Cost Sharing

Cost sharing with Medicare may seem complicated, and a licensed agent with Medicare Plan Finder can help you determine what you need. Our agents are highly trained, and they can find the Medicare Advantage, Medicare Supplement, and/or Medicare Part D plans in your area. To arrange a no-cost, no-obligation appointment with an agent, call 1-844-431-1832 or contact us here.