How Medigap is Unique in Minnesota, Wisconsin, and Massachusetts

September 20, 2019In most of the United States, Medigap (also called Medicare Supplements) can be characterized by eight different types of plans (A, B, D, G, K, L, M, N). However, there are three states that work completely differently: Massachusetts, Minnesota, and Wisconsin.

A lot of the information you’ll see on the internet about Medicare Supplement plans talks about those eight plans, but we haven’t forgotten about you, Massachusetts, Minnesota, and Wisconsin! If you live in one of those three states, this guide is for you.

Psst…click below to read more about Medicare programs in each state:

What is Medigap, Anyway?

If you already have a basic understanding of Medigap, you can skip ahead to the section about your state below.

Medigap is a type of private Medicare insurance that is not technically part of the government-sponsored Medicare program. Medigap plans are also called Medicare Supplements. The two terms can be used interchangeably. To enroll in Medigap, you have to enroll in Original Medicare first.

Additionally, you cannot have a Medicare Supplement plan and a Medicare Advantage plan at the same time. Click here to find out if Medicare Advantage is better for you than Medicare supplements.

What Does Medigap Cover?

Uniquely, Medicare Supplement plans do not typically provide additional health benefits. Instead, Medigap plans provide additional financial protection. For example, let’s say you get sick and have to go to the doctor at least once per month for treatment. Original Medicare may not cover the entire cost for you. You might have to pay your deductible first ($185 for Part B in 2019) and then 20% coinsurance on every visit.

If you have a Medicare Supplement plan that includes deductible and coinsurance coverage, you may not have to pay that $185 and 20%. Instead, you’ll only have to pay your Part B* premium and your Medigap premium.

Medigap and Preexisting Conditions

You may have heard that you cannot be denied Medicare coverage based on your age or preexisting conditions. While that’s true, Medigap is a little different. If you enroll in a Medicare Supplement plan during your Initial Enrollment Period (the time when you first become eligible for Medicare), that holds true. However, if you wait too long to enroll, there is a chance that your plan will be put through underwriting and your prices may increase, or you may be denied coverage based on your age and preexisting conditions.

*Some people may have a Part A premium as well.

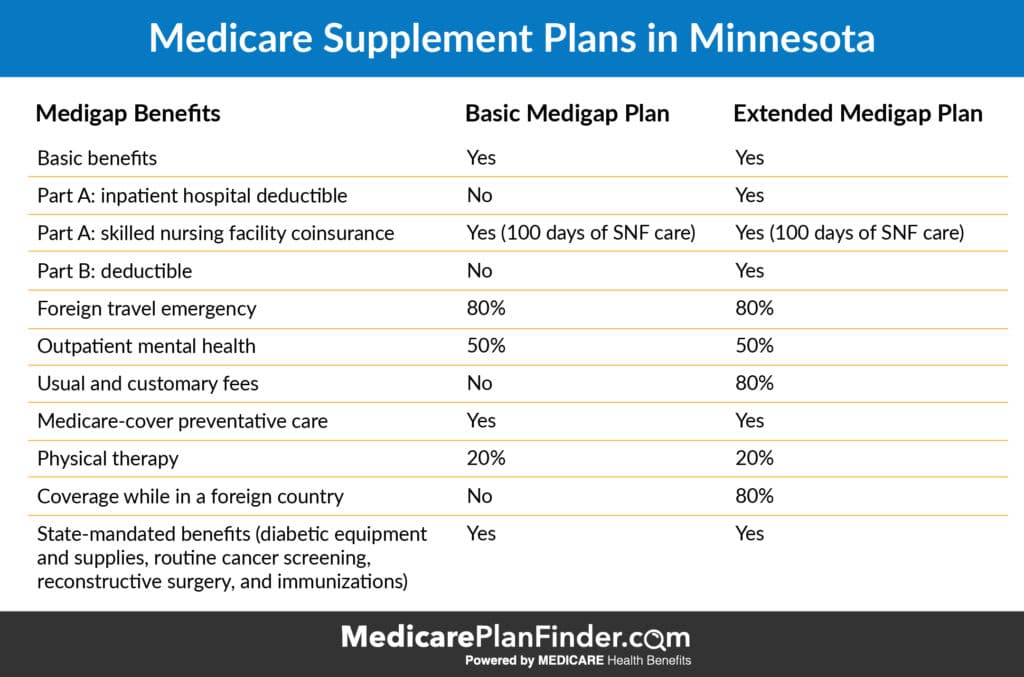

Minnesota Medicare Supplement Plans

While you can’t get the same eight plans (A, B, D, G, K, L, M, N) in Minnesota that are offered in other states, there are technically modified versions of plans K, L, M, and N available.

Additionally, Minnesota offers two unique plans: The “Basic Plan,” and the “Extended Basic Plan.”

The preexisting conditions underwriting may apply. However, you’ll get a 6-month Medigap enrollment period (where age and preexisting conditions do not apply) if you return to work or if you drop Part B in favor of your employer’s health plan.

Regardless of your age or health problems, everyone who applies for Minnesota Medicare Supplement Plans can have these basic benefits:

- Part A coinsurance for inpatient hospital care

- Part B coinsurance for medical costs

- First three pints of blood each year

- Part A hospice and respite cost-sharing

- Parts A and B home health cost-sharing

The “Basic Plan” then offers (in addition to the basic benefits):

- Preventive care

- 100 days of Part A skilled nursing facility coinsurance

- 80% of foreign travel emergency

- 50% of outpatient mental health

- 20% of physical therapy

- State-mandated benefits:

- Diabetic equipment

- Routine cancer screenings

- Reconstructive surgery

- Immunizations

The “Extended Basic Plan” adds on:

- Part A deductible for inpatient hospital stays

- 120 days of Part A skilled nursing facility coinsurance

- Part B deductible (no longer available in 2020)

- 50% of outpatient mental health

- 20% of physical therapy

- 80% of foreign travel emergency, then 100% after you spend $1,000 per year out-of-pocket

- 80% of “usual and customary fees,” then 100% after you spend $1,000 per year out-of-pocket

So you’re probably wondering, if the Minnesota Medigap Basic Plan and the Extended Basic Plan both always offer the same benefits, why would you choose one Basic Plan over another?

The answer is that costs can vary and plans are allowed to add some extra benefits. There are four additional benefits that plans are permitted to add to the Basic and Extended Basic plans: Part A inpatient deductible, Part B deductible (no longer available in 2020), usual and customary fees, and non-Medicare preventive care.

Wisconsin Medigap Plans

Medigap in Wisconsin starts with a “Basic Plan,” which covers:

- Part A coinsurance for inpatient hospital care

- Part B coinsurance for medical costs

- First 3 pints of blood per year

- Part A hospice coinsurance/copayments

- Part A skilled nursing coinsurance

- 175 days of lifetime inpatient mental health

- 40 additional home healthcare visits

- Other state-mandated benefits:

- At least $30,000 for kidney disease treatment (dialysis, transplants, etc.)

- Insulin pumps, self-management training, and other diabetes care

50% and 25% cost-sharing plans are also available, which are similar to Medigap Plan K and Medigap Plan L (which would be available in other states).

So, you might be wondering why you have multiple options to choose from for Wisconsin Medigap plans if they are all supposed to be the same “basic” plan. The answer to that is that plans ARE allowed to add additional benefits other than what is in the basic plan, and the costs can vary. Companies are allowed to add the following benefits:

- Part A deductible

- 365 additional home care visits

- Part B deductible (no longer available in 2020)

- Part B excess charges

- Foreign travel emergency

- 50% Part A deductible

- Part B copayments/coinsurance

Massachusetts Medigap Plans

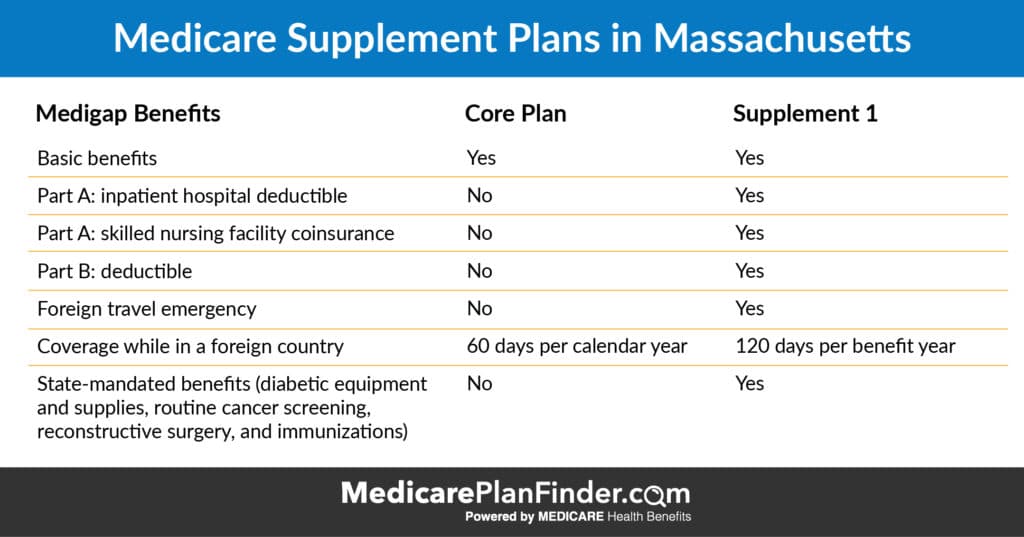

Massachusetts Medigap has two generic plans available: the “Core Plan,” and “Supplement 1.”

Both plans cover the following basic benefits:

- Part A coinsurance for inpatient hospital care, plus 365 additional days

- Part B coinsurance for medical costs

- First 3 pints of blood per year

- Part A hospice coinsurance/copayments

The Core Plan covers:

- The basic benefits

- 60 days per year of inpatient mental health care

- State-mandated benefits such as:

- Pap tests

- Mammograms

The Supplement 1 Plan covers:

- The basic benefits

- Part A inpatient hospital deductible

- Part A skilled nursing facility coinsurance

- Part B deductible (no longer available in 2020)

- Foreign travel emergency

- 120 days per year of inpatient mental health care

- State-mandated benefits such as:

- Pap tests

- Mammograms

Why Can’t I get Part B Deductible Coverage in 2020?

When MACRA (The Medicare Access and CHIP Reauthorization Act) passed in 2015, a couple of changes were made that didn’t take effect right away; Losing Part B deductible coverage was one of them.

Congress made the decision to not allow plans to cover the Part B deductible starting in 2020. This decision saves money for the Medicare program and doesn’t have an astronomical effect on you. The Part B deductible was only $185 in 2019. All this means is that you will have to pay $185 out-of-pocket before the rest of your coverage kicks in.

It also means that if you are already enrolled in one of the plans listed above that includes the Part B deductible, you won’t lose that coverage. However, if you decide to switch plans or drop that coverage at any time, you won’t be able to get back into it starting in 2020.

How do I Decide Which Medigap Plan is Right For Me?

Regardless of which state you live in, we have a plan finder tool that can help you compare your options.

We also have licensed agents available to answer your questions and help you make your final decision. To find out if there is an agent near you that you can meet with, call 844-431-1832 or send us a message by clicking the “let’s chat” button in the bottom right corner.