Medicare Plan F Going Away (and Plan C) | ENROLL NOW!

December 5, 2019What’s all this talk about “Medicare Plan F?” Is Plan F going away?

It’s true – Medicare Supplement Plan F is GOING AWAY in 2020! If you still want Plan F, you only have until December 31, 2019, to get locked in.

What are Medicare Supplements, anyway?

When you enroll in Original Medicare (Part A and Part B), you have the option of increasing coverage by purchasing a Medicare Supplement plan (also called Medigap). These plans work alongside Original Medicare and add financial benefits (like help paying for your copayments, coinsurance, and yearly deductibles).

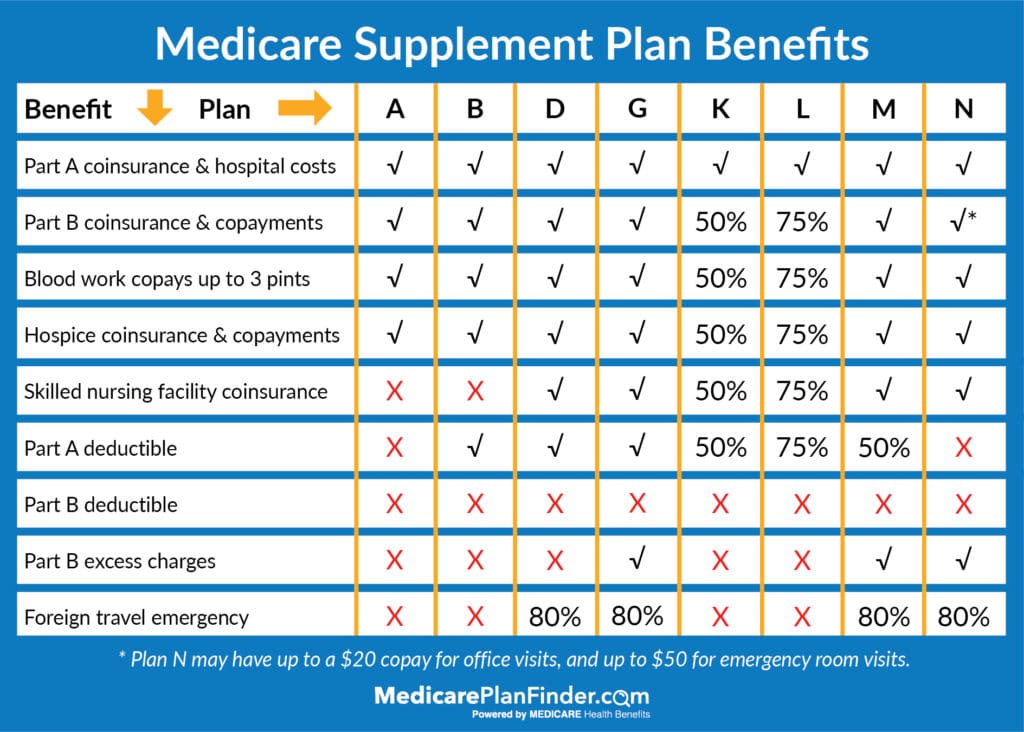

Every state (except Massachusetts, Minnesota, and Wisconsin) has ten different types of plans. Each plan is represented by a different letter (A, B, C, D, F, G, K, L, M, and N). Plan F and Plan C are the most inclusive, and in turn, are the most popular. But did you know both plans are going away in 2020?

Read more about each type:

- Medigap Plan A

- Medigap Plan B

- Medigap Plan D

- Medigap Plan G

- Medigap Plan K

- Medigap Plan L

- Medigap Plan M

- Medigap Plan N

Make sure you do not confuse Medigap Plan A with Medicare Part A – they are two very different things!

Medicare Plan F Benefits

Plan F has been a top-seller in many states for years and is the most comprehensive Medigap plan. Medicare Plan F covers:

- Blood work copays up to three pints (100%)

- Foreign travel emergency (80%)

- Hospice coinsurance and copayments (100%)

- Part A coinsurance and hospital costs (100%)

- Part A deductible (100%)

- Part B coinsurance and copayments (100%)

- Part B deductible (100%)

- Part B excess charges (100%)

- Skilled nursing facility coinsurance (100%)

Medicare Plan C Benefits

Medicare Plan C covers all of the gaps from Original Medicare except for Part B excess charges. More specifically, Plan C includes the following:

- Blood work copays up to three pints (100%)

- Foreign travel emergency (80%)

- Hospice coinsurance and copayments (100%)

- Part A coinsurance and hospital costs (100%)

- Part A deductible (100%)

- Part B coinsurance and copayments (100%)

- Part B deductible (100%)

- Skilled nursing facility coinsurance (100%)

Plan F vs Plan C

Plan F is very similar to Plan C. The only difference is that Plan C does not cover Medicare excess charges. If a doctor does not accept Medicare assignment rates, you will be responsible for excess charges, but it can not exceed 15% of what Medicare pays. Some states do not allow doctors to issue excess charges. If this is the case, Plan C will operate identically to Plan F.

States that don’t allow excess charges are:

- Connecticut

- New York

- Ohio

- Massachusetts

- Minnesota

- Pennsylvania

- Rhode Island

- Vermont

Why is Medicare Plan F Going Away?

Back in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. According to the act, starting on January 1, 2020, Medicare Supplement plans can no longer cover the Part B deductible, something that only Medigap Plans F and C currently cover.

When people don’t have to pay a deductible for services, they can end up overusing the doctor. For example, the might schedule an appointment with their doctor for a flu shot instead of using the free clinic inside their local grocery store. By visiting the doctor unnecessarily (and not paying for it), doctor’s offices are getting crowded and doctors aren’t being fully compensated for their time.

Eliminating Part B deductible coverage through Medigap works better financially for the Medicare program and for the doctors who accept it.

Thankfully, that Part B deductible is a small price to pay at less than $200 per year.

When will Medicare Plan F be discontinued? What about Plan C?

If you currently have Medicare Supplement Plan F or Plan C, don’t fret! This policy change only affects new beneficiaries. While your rates may increase (as they technically do every year), you will not lose your current coverage. However, if you leave your Medigap Plan F or Plan C for whatever reason, you will not be able to go back to it after 2020. If you do not have Plan F or Plan C, but you would like to, you can lock yourself in by enrolling NOW. You must enroll before January 1, 2020, to receive Plan F or Plan C coverage.

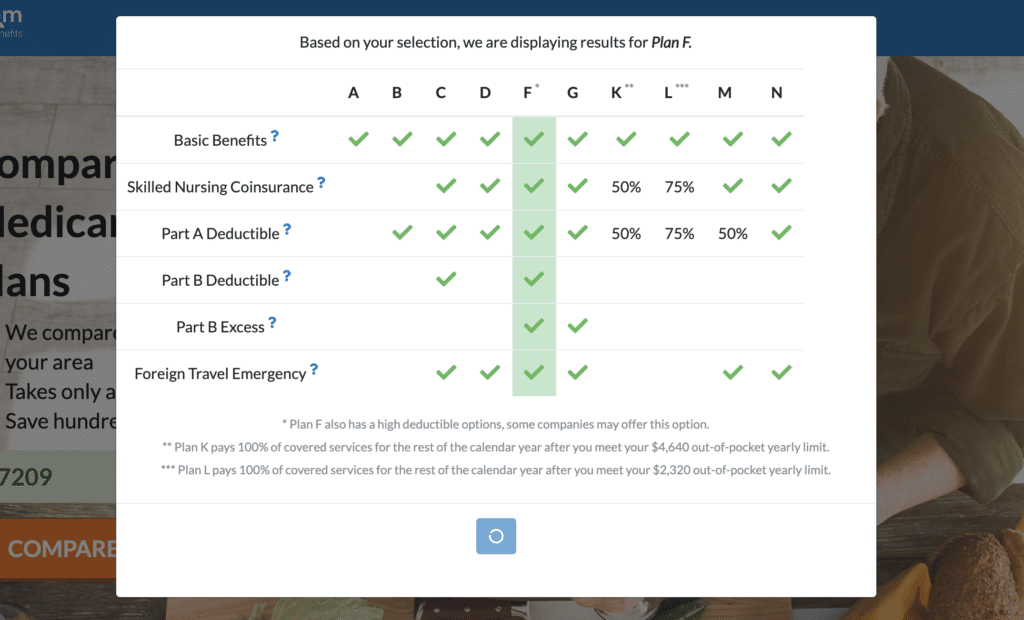

Due to this change, Plan F and Plan C beneficiaries will be given a chance to compare rates and switch to a new policy. If you decide you may want to switch, you can start by using our Medicare Plan Finder tool to decide what plan option (other than F) is best for you. If you still need help, click here to request a call from a local and licensed agent!

Will Plan F Costs Go Up in 2020?

It is certainly possible that Plan F costs will go up as it is phased out, though it hasn’t been confirmed yet.

Uniquely, the state of Idaho released a memo stating that the Idaho Department of Insurance “is NOT anticipating abnormally large premium increases on Plan F after 2020” in response to questions about Plan F leaving the market. Even people who already have Plan F in Idaho and want to switch to a different Plan F after this year should not face large rate increases.

Can I Get Plan F in 2020?

Medicare Plan F is discontinued in 2020. If you missed the deadline of December 31, 2019, you won’t be able to enroll in Plan F for the first time. If you already have Plan F, don’t worry – you can keep your coverage.

To see what Medicare Supplement options are available for you, go to https://www.medicareplanfindertool.com/.

You’ll be asked to enter your zip code to get started. Then, you’ll have to answer a few questions: your gender, your date of birth, whether or not you smoke, and what kind of premium you want. After submitting some basic information, you’ll see a list of the plans that the tool recommends for you.

The system may or may not recommend Plan F based on the way you answered the questions.

When to Enroll in Plan F

If you still want Medigap Plan F, you have just a little bit of time left to enroll. The deadline is December 31, 2019. After then, Plan F will be discontinued for new members.

What is a good alternative to Plan F?

Many seniors and Medicare eligibles who already have Plan F are deciding to drop Plan F altogether and switch to Plan G. Plan G covers everything that Plan F does minus the Part B deductible, and it typically has a lower monthly premium.

Another popular plan is Plan N. The only benefit that is included in Plan G and not Plan N is the coverage for Part B excess charges. However, the thing to remember about excess charges is they are relatively rare. You will only be charged an excess charge if your provider does not accept Medicare.

Medicare Plan F vs Plan G

Great news! Plan G is almost identical to Plan F! The only difference is that Plan G does not cover the Part B deductible. Plan F may technically cover more, but many people consider Plan G to be a better value. Yes, you will need to pay your Part B deductible upon your first outpatient visit, but after you pay the deductible, you won’t need to pull your wallet out for the remainder of the year. Since you have to pay the Part B deductible yourself, Plan G has lower monthly premiums, and you could save more than $400 a year!

The standard Part B deductible for 2020 is $198, so the savings from choosing G over F significantly outweighs the cost of the deductible.

Is Medicare going away or just certain plans?

No, Medicare is not going away! Don’t panic!

Both Medicare Plan F and Medicare Plan C will be discontinued on January 1, 2020, but other options may be available in your area. We get it, Medicare coverage and plan options can be confusing and stressful. Policies are constantly changing, and healthcare will continue to evolve.

At Medicare Plan Finder, our agents are kept up to date on all the plans in your area and can help you find a plan that suits your needs and budget. If you’re interested in arranging a no-cost, no-obligation appointment, click here or give us a call at 833-431-1832.

This blog was originally published on October 23, 2018, by Kelsey Davis. The latest update was updated on December 5, 2019, by Troy Frink.