What Is a Medicare SELECT Plan?

October 22, 2019Medicare is a giant healthcare system that helps eligible people receive medical services. However, it doesn’t cover everything health-related. One tool that people use to afford healthcare is called a Medicare SELECT plan.

What Is Medicare SELECT?

A Medicare SELECT plan is a type of Medicare Supplement (Medigap) plan. Medigap plans are private insurance policies that can help close the gap between your coverage and what you pay. Medicare SELECT plans require you to use a specific network of medical facilities and healthcare providers.

How Does a Medicare SELECT Plan Work?

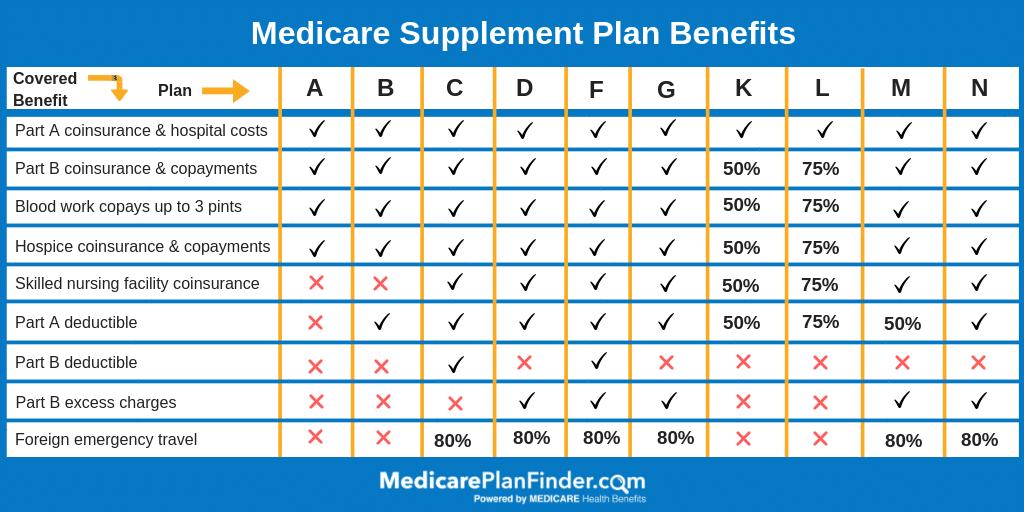

A regular Medicare Supplement plan provides coverage anywhere that accepts Medicare. In 2019, there are 10 standardized Medigap plans you can enroll in. Covered services depend on which “letter” you buy, but each letter offers the same coverage in every state.

Plans that cover the Medicare Part B deductible (Plan C and Plan F) will not be available to anyone newly eligible for Medicare after January 1, 2020. If you qualify for Medicare and want coverage for those items now, talk to an agent today!

Medicare SELECT policies are different from other Medigap plans because they aren’t accepted everywhere that takes Medicare. Also, Medicare SELECT is different because not all 50 states have plans available.

Medicare SELECT premiums depend on a variety of factors, but because they feature smaller networks than normal Medigap plans, Medicare SELECT premiums may be less.

Is Medicare SELECT Different Than Medicare Advantage?

Medicare SELECT is different than Medicare Advantage because of what the plans cover. Because Medicare SELECT is a type of Medicare Supplement policy, it only covers financial items such as deductibles, coinsurance, and copays.

Like Medigap policies, Medicare Advantage plans are private insurance policies. However, Medicare Advantage plans cover medical services, and they can offer supplemental benefits such as vision, hearing, dental, and fitness classes. You must choose either a Medigap plan or a Medicare Advantage plan. You cannot have both.

Certain Medicare Advantage plans called HMOs are a lot like Medicare SELECT, because they can feature smaller networks of providers than Medicare Advantage PPOs or regular Medigap plans.

When Can I Buy Medicare SELECT?

According to the Medicare Rights Center, the best time to enroll in a Medigap plan is during your Open Enrollment Period (OEP), which is the six months after you’ve enrolled in Medicare Part B.

If you miss your Open Enrollment Period, you can buy a Medigap plan when you have a guaranteed issue right. For example, you have guaranteed issue within “63 days of losing or ending certain kinds of health coverage.”

You may also have a guaranteed issue right if you enrolled in a Medicare Advantage plan when you were first eligible for Medicare and disenrolled within one year. Other circumstances that may allow you to have guaranteed issue are if your private Medicare plan ends coverage or you move out of the plan’s service area.

If you decide a Medicare SELECT or any Medicare Supplement policy isn’t for you, you can cancel within 30 days of starting coverage. However, you should cancel with caution, because you may not be able to buy another policy depending on where you live, and you might get charged more because of your health.

If you buy a Medicare SELECT policy and you don’t like it, you can switch to a standard Medicare Supplement plan within 12 months of your Medicare SELECT policy taking effect.

Learn More About Medicare SELECT

Medicare SELECT plans aren’t available in every state. A licensed agent with Medicare Plan Finder can show you what’s available in your area and help you make a decision. Our agents are highly trained and may be able to find a plan that fits your budget and lifestyle. Call 844-431-1832 or contact us here to set up a no-cost, no-obligation appointment today.