Durable Medical Equipment: What Medicare Beneficiaries Should Know

November 8, 2019According to the American Association for Homecare, about 15.5 million people use Durable Medical Equipment (DME) every day. Not every piece of medical equipment is considered DME, however. Did you know that in most cases, for Medicare to cover your medical equipment, the equipment has to be considered DME?

What is Durable Medical Equipment?

Durable Medical Equipment is any medical device that can be used repeatedly (for a duration of at least three years), can be used at home, and is medically necessary for the patient.

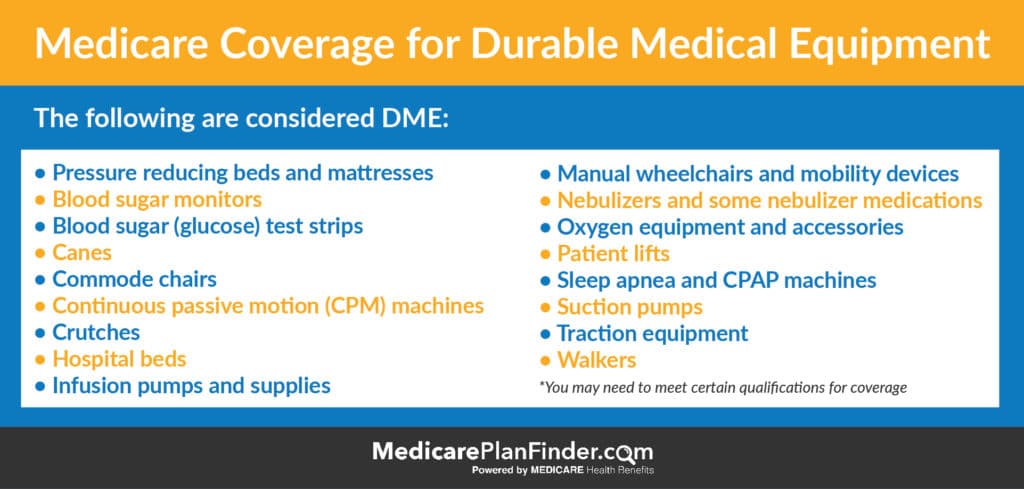

Examples of Durable Medical Equipment

- Hospital beds

- Canes, walkers, crutches, wheelchairs, etc.

- Oxygen equipment

- Nebulizers and the related medications

- Sleep apnea devices

- Infusion pumps and related supplies

- Catheters and commode chairs

- Glucose monitors and diabetes test strips

- Some Medicare Advantage plans can now cover home modifications like handrails and wheelchair ramps. However, they are not normally considered DME.

Click here for a more comprehensive list.

Home Medical Equipment

Plans may not necessarily cover these items, but you may see them referred to as durable medical equipment:

- Bedding protection and adult diapers

- Cleansers and cloths

- Bath lifts, shower seats, and grab bars

- Ostomy supplies

- Mobility tools

Something to keep in mind about durable medical equipment is that it does not necessarily refer to items used in nursing homes, hospitals, and doctors office – it actually more commonly refers to common home medical equipment.

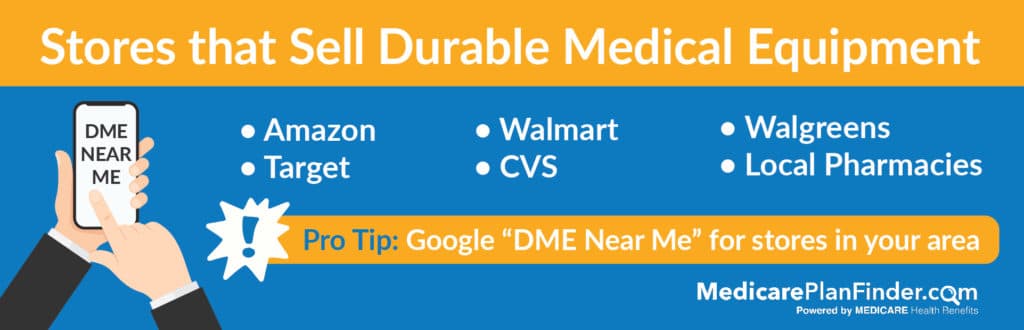

Medicare Medical Supplies in Stores

If you’re looking for Medicare durable medical equipment or other home medical supplies, you should check with your plan details to see if there are any requirements for where you buy your materials if you want coverage.

You can probably buy a lot of these items from Amazon, Target, or Walmart, but a pharmacy like CVS, Walgreens, or other form of Medicare medical supplies store may be the best way to go so you can make sure you are receiving coverage. If you’re unsure what stores carry DME in your area, Google “DME near me.”

You may need to start by getting a prescription from your in-network doctor.

DME Medicare Coverage

Hospitalized clients will receive DME coverage through Medicare Part A, but others will fall under Part B. Under Part B, Medicare will pay 80% of the cost (after you’ve met your deductible).

If you need special items like blood testers and oxygen equipment, you’ll need to purchase them outright. Some equipment, like wheelchairs and other large items that you may not need forever, can be rented.

The first step to purchasing or renting DME with Medicare coverage is seeing a doctor. Most DME will require a prescription to prove that the DME is medically necessary. You must get this prescription or official doctor’s note within six months of the day that you rent or purchase your equipment.

How to Get Medicare DME Coverage

Some Medicare plans will have their own DME suppliers. Check with your plan’s website to see if there’s a special place where you can buy your equipment to make sure you get coverage for it. If you need help, your agent can help you figure it out. If you don’t currently have an agent, we can set you up with a free appointment.

We’ll send a licensed agent in your area to your home to help you find the coverage you need. Click here to set up an appointment or call 1-844-431-1832.

This post was originally published on April 12, 2018, and updated on November 8, 2019.