What is Medicare Part B Buy Back/Give Back?

November 14, 2019Are Medicare Buy Back plans too good to be true?

No!

Can they really put money back into your social security check?

Yes, it’s offered through SOME Medicare Advantage plans but not all.

Here is how it works.

Some Medicare Advantage plans out there that can “buy back” your monthly Part B premiums, ultimately putting money back into your pocket. You’ve likely seen this on TV, but unfortunately it’s misleading as this specific benefit is narrowly used by a few plans across the country.

These plans are effectively paying you instead of the other way around! Let me explain.

Medicare Part B Premiums in 2022

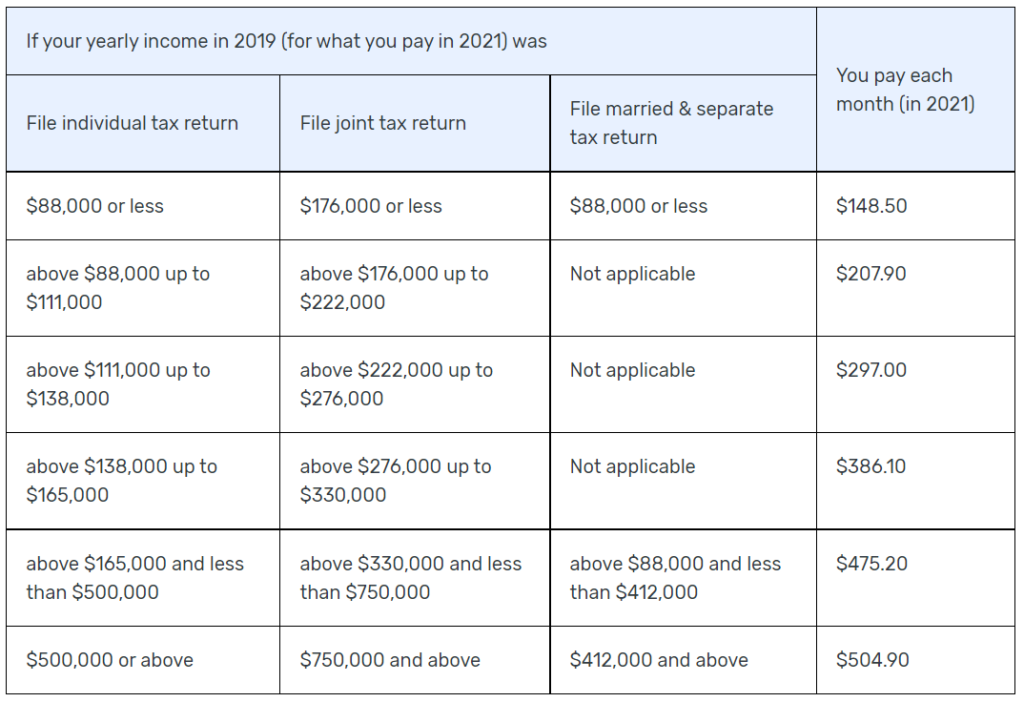

In 2022, the standard Medicare Part B premium will be $148.50. Your premium may be a bit higher if you have a higher income. Below is a snap shot directly from Centers for Medicare and Medicaid about the current Part B premium scale.

The reason you have to keep paying this premium is because Medicare Part B is a paid program, unlike Medicare Part A which you earned during your working years by paying social security taxes. By default, everyone has to pay for Medicare Part B unless they get some kind of financial assistance.

While Medicare Part B is a part of original Medicare, Medicare Advantage plans are privately owned and offer additional benefits beyond original Medicare. In particular, Part B buy back is an additional benefit offered by some plans. This is sometimes confusing to many people, so bear with me.

To have Medicare Advantage, you must be enrolled in original Medicare Parts A and Parts B. In order to be enrolled in original Medicare, you must have worked 40 quarters (or 10 years) paying into social security to earn Part A, and then pay a monthly premium for Part B. To stay enrolled, you have to continue paying your premiums!

You can’t get a Medicare Advantage plan without having original Medicare.

What are Medicare Advantage Part B Buy Back Plans?

Medicare Advantage plans are additions to your existing Medicare coverage. They can vary greatly in coverage amounts and premium prices. Some Medicare Advantage plans can come with a $0 premium or a low premium in addition to a Part B buy back (or give back, as some plans call it).

If you pay your Part B premium automatically out of your Social Security check, this could feel like a bonus added to your monthly checks! You’ll start seeing a bit more coming in, which is nice, assuming the plan you choose has the buy back option.

Premium Give Back Plan? What’s the Catch?

You’re probably skeptical about the idea of an insurance company wanting to give YOU money.

However, there’s not really a catch. According to Quality Health Plans of New York, Medicare Advantage plans “may choose to use some of the funding it receives” to “reduce its members Medicare Part B premium.”

So, what these plans are doing is providing you an incentive to sign up for their plans.

Even if they give you some of that money back for your Part B premiums, they still get paid from your copayments, deductibles, etc.

As you’re looking into available Medicare Advantage plans that offer Part B buy back benefits in your area, be sure to consider what you might be giving up.

Remember, all plans are different, but it is possible that a plan with a Part B buy back option will have higher copayments and deductibles – which may not matter to you if you don’t spend a lot of time in the doctor’s office! The devil is in the details.

I guess you could say the only true “catch” to these plans is that you have to stay enrolled in Medicare parts A and B – but that’s true of any Medicare Advantage plan. You’ll have to continue paying your A and B premiums, even if you do get some of that money back.

Additionally, it may be a few months after you sign up for your premium give back plan before you receive your first Part B reimbursement.

How do I Get a Part B Buy Back (Give Back) Plan?

Great question! As you can imagine, these plans might be harder to find than more standard Medicare Advantage plans, and there may or may not be one available in your area.

Unfortunately, CMS (Centers for Medicare and Medicaid Services) does have certain rules in place that forbid us from sharing the plan details with you publically. However, we have licensed agents across the nation who can meet with you either in person or by phone to help you choose a plan.

If you’re interested, call us at 800-691-1832. Let us know that you’re interested in Part B buy back plans, and we’ll do all we can to help!

You can also leave us a message here, and we’ll get back to you.