Does Medicare Pay for Home Health Care?

April 17, 2019Home health care is usually equally as effective as the care you would receive in a hospital or facility. If you have an injury or illness that prevents you from leaving your house, you’ll want to consider home health care.

Home health care coverage refers to not only in-home doctor visits and nurses, but also support for your family members who are taking care of you.

Medicare can cover the costs of your home nurse or doctor and can reimburse for caregiver services. However, if your relative is caring for you for the sake of saving money, it may be a good idea to take a look at what kind of coverage you might have for in-home doctors and nurses.

So, what does Medicare pay for home health care? The Original Medicare program covers hospital services under Part A, and it covers medical insurance needs such as doctor visits and limited home health care services under Part B.

Medicare Part C, or Medicare Advantage (MA) health insurance plans are from private insurers and can offer “extra” home healthcare benefits.

Medicare Home Care Benefits

Over the past few years, home health care services have greatly expanded. More and more seniors prefer to receive the care they need at home instead of in a nursing home or other facility.

However, nursing homes and long-term care facilities can be more expensive than home health care, because home care eliminates the need for room and board.

Kaiser Health News reports that over six million American seniors require home care. That means that they need help with dressing, bathing, eating, and other daily activities. However, a basic Medicare plan may not provide enough coverage for home care.

Having a nurse or aide in your home can cost well over $40,000 per year. With long-term care insurance, you’ll pay a premium instead, and your yearly costs will total at just over $2,000.

You’ll need to determine how much coverage you need ($50 per day, $100 per day, etc.) and what you’ll be using it for. You can use a long-term care policy for anything from a full-time nurse to home modifications, like ramp installations.

What Medicare Covers

Medicare does pay for some home care services if leaving your house is a tremendously difficult process and you need assistance.

Parts A or B (Original Medicare) covers skilled nursing services on an inconsistent basis – at least one time every two months, but only up to once a day, and only for three weeks at a time.

“Skilled care” means that it has to be performed by a qualified health care professional, or at least under his or her supervision.

Medicare Parts A and/or B will also cover physical therapy for recovery from injuries or illnesses, occupational therapy to help you learn how to perform day-to-day tasks with or without tools, and social services for medical needs.

While Original Medicare will cover basic home care, additional services such as housekeeping and meal delivery fall under specific Medicare Advantage (Part C) plans.

Does Medicare Pay for Home Health Care by a Family Member?

Original Medicare will only cover services provided by a skilled healthcare professional. However, some state Medicaid programs will pay family members as caregivers.

How to Find Affordable Home Health Care

Your doctor will probably recommend a home health care service to you if he doesn’t provide those services himself. Otherwise, Medicare has a Home Health Agency finder so you can locate the care you need in your area. When choosing an agency for yourself or for a loved one, make sure you’re asking the right questions, such as:

- Are you Medicare (or Medicaid) certified?

- Do you offer ____ service?

- What are your hours and do they align with my needs?

- Will you have emergency staff available on weekends and after hours?

- Do you perform background checks on staff? Do you have credentials?

- Will I have to pay anything out of pocket?

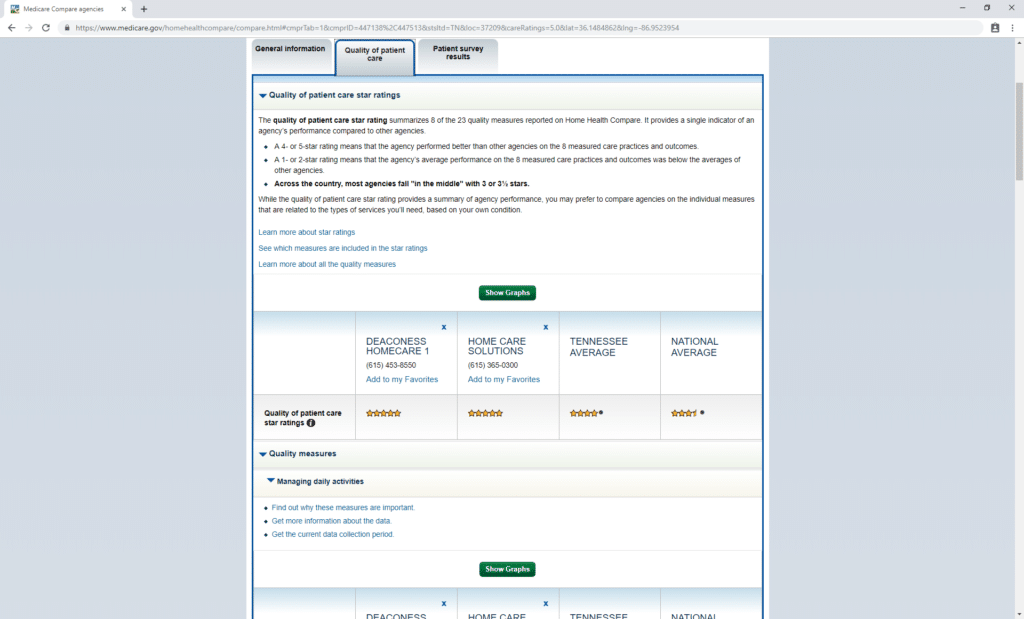

Once you’ve narrowed your choices down, you may want to inquire about an agency’s quality of care. Any home care agency who services Medicare clients and has serviced at least 20 patients will have a star rating.

Patient Care Star Ratings are based on patient health improvement and the outcome of home treatments and care.

How to Use Medicare’s Home Health Agency Finder

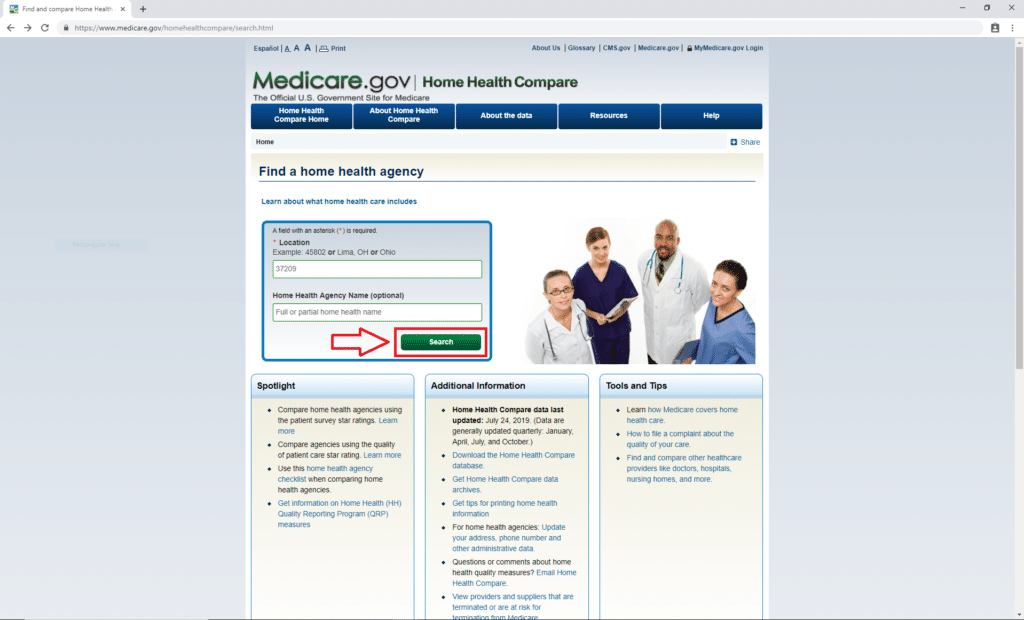

Click here to go to the Medicare Home Health Agency finder. Enter your zip code to search for home health agencies in your area and click “search.” We used 37209, which is the zip code for our corporate offices in Nashville, Tennessee.

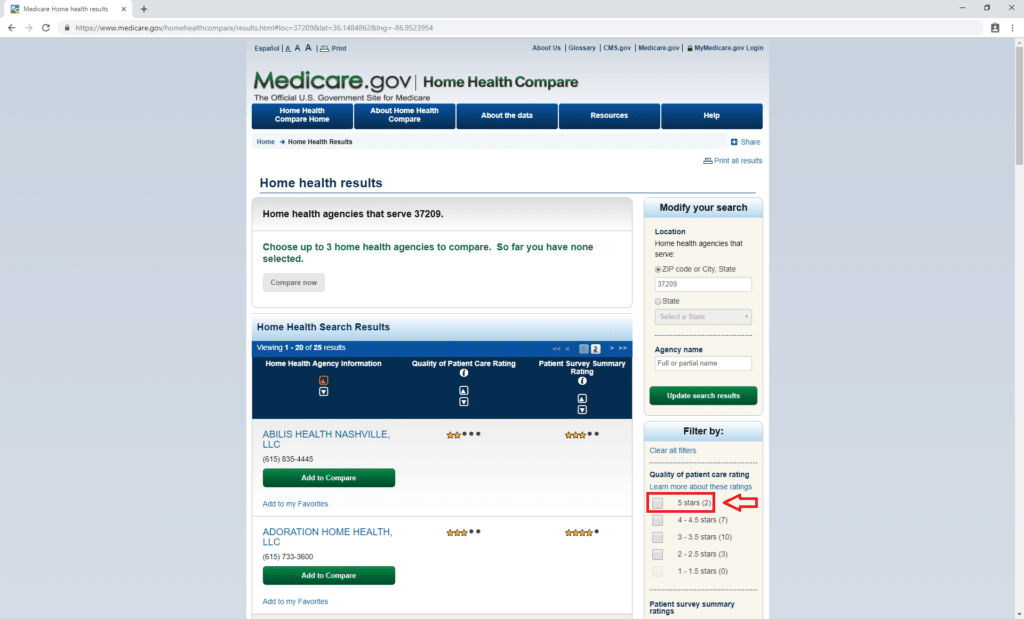

From there, you can filter search results by Medicare’s star rating and patient survey results. For demonstration purposes, we are only going to choose facilities with 5-star ratings.

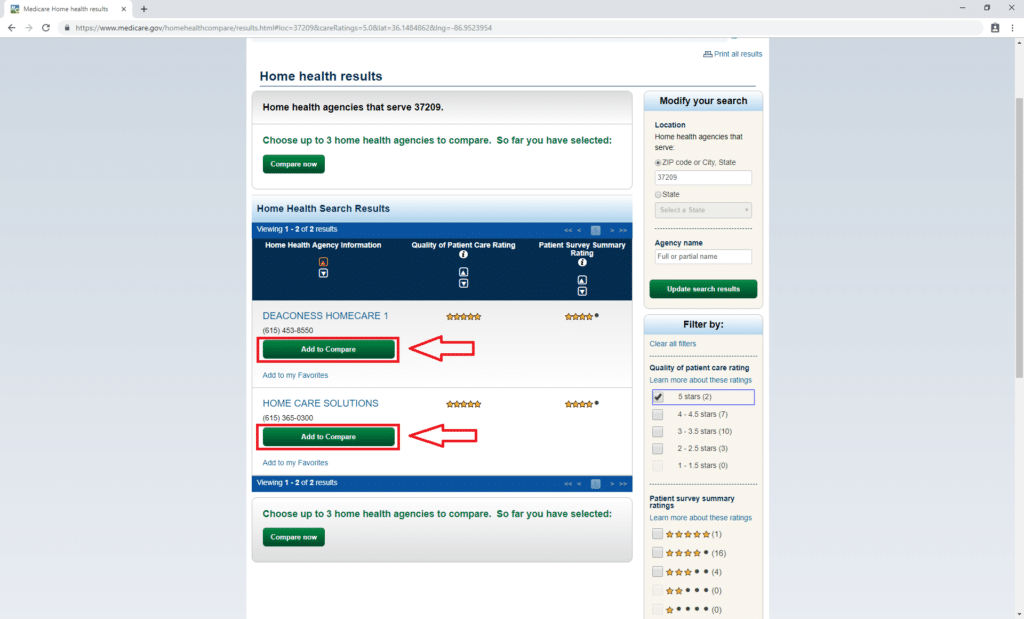

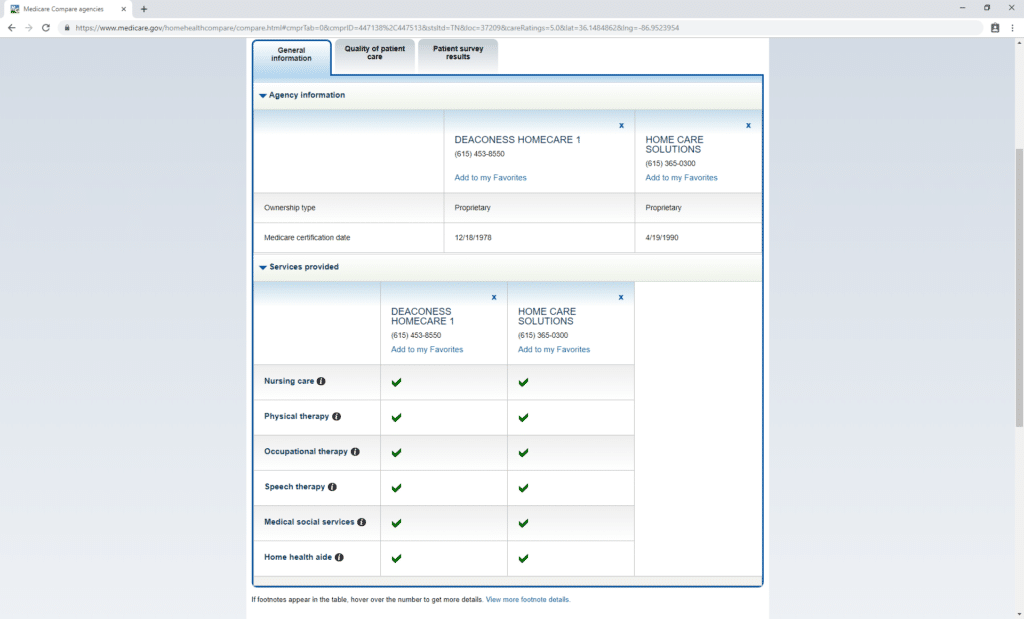

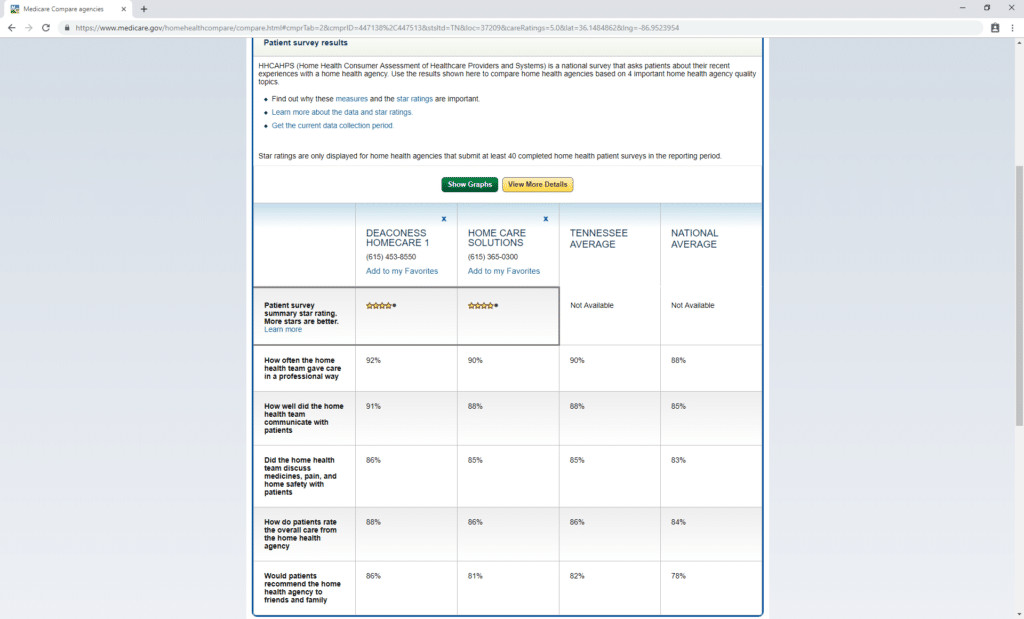

Once the agency finder returns your search results, click on the agencies you want to compare. In our case, the finder returned two results. In this instance, both Deaconess Homecare and Homecare Solutions are part of LHC Group Health Care, which has locations in 38 states. The agency’s proximity to your home may be a determining factor in your choice for home care.

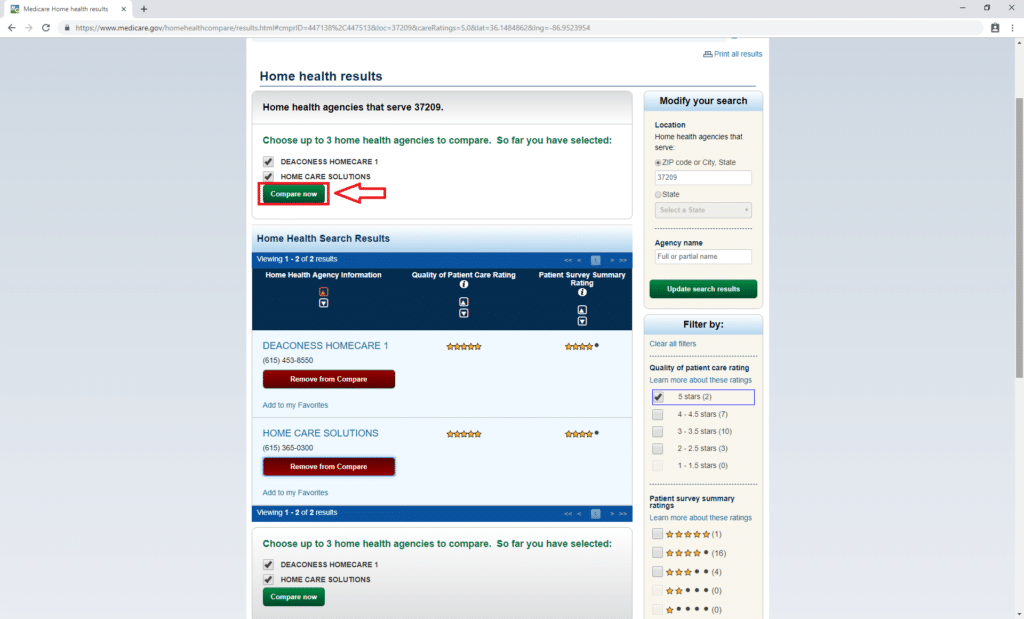

Then click “compare now.”

Then the agency finder will show you comparison charts with general information, quality of patient care, and patient survey results. Use the comparison charts to help you make a decision about which home health agencies you want to contact.

How Do I Qualify for Home Benefits?

To qualify for home benefits, a doctor will need to certify that you have a medical need. For example, your policy will not pay for your stair lift if you still can walk up the stairs on your own without too much difficulty.

As another example, if you only need a nurse to help you with something occasional, like blood transfusions, your policy will not pay for you to have a full-time live-in nurse.

Your doctor will have to meet you in person to determine that you are homebound and need skilled nursing care. After your initial certification, your doctor must recertify your home health care plan once every two months. A Medicare-certified home health agency (HHA) must provide the care.

When You Should Buy

Like other health insurance policies, you should buy a long-term care policy before you need it. Pre-existing conditions and your age can raise your premiums. If you buy while you’re still healthy, you’ll likely have lower costs. However, if you can’t afford the premium now, while you’re healthy, then it may be best to wait.

One of our licensed and experienced agents can help you figure out if a long-term policy is something you should buy now or wait for. If you think it’s time to buy now, we’ll help you find a great plan in your area.

To set up an appointment, call 844-431-1832 or contact us here.

This post was originally published on December 07, 2017, by Anastasia Iliou, and was updated on August 07, 2019, by Troy Frink.