Does Medicare Cover Physical Therapy?

January 6, 2020Does Medicare cover physical therapy? It depends. Medicare can help pay for physical therapy, which may be a crucial part of injury or surgery recovery. However, Medicare’s coverage has limits.

Every Medicare beneficiary begins with Original Medicare, which includes Part A, hospital coverage, and Part B, medical coverage. Most physical therapy services will fall under Medicare Part B – however, there are specific Medicare guidelines for physical therapy in-home health services and doctor services.

It can be confusing to navigate the different coverage caps and figure out what Medicare therapy coverage you have. Let’s break it down.

Does Medicare Cover Physical Therapy for Back Pain?

Back pain is one of the most common symptoms that leads to physical therapy. As you age, back pain is almost inevitable. It’s easy to fall into bad habits and poor posture. If you have back pain that lasts for a few weeks or longer, most doctors will recommend physical therapy.

A licensed and professional physical therapist will not only help you decrease pain but also educate you on how to prevent back pain in the future. He or she may even teach you some physical therapy exercises to perform at home.

Alternatively, seniors and Medicare eligibles who have a hard time getting to a doctor’s office may opt for a home nurse who is licensed to assist with physical therapy. In most cases, if your home nurse happens to double as a physical therapist, you will be covered under Part B.

Unfortunately, these services are not free.

How Much Does Medicare Pay for Physical Therapy?

Medicare Part B will cover your medically necessary outpatient therapy (physical, speech-language pathology, occupational) at 80 percent, you will likely be responsible for 20 percent of all Medicare-approved costs.

The Physical Therapy Cap

The Medicare physical therapy cap was eliminated by the Bipartisan Budget Act of 2018.

Previously, Medicare only covered up to 80 percent of $2,040 ($1,608) for physical and speech-language therapy services and another 80 percent of $2,040 ($1,608) for occupational therapy services. That meant that, for example, if your physical therapy appointments cost you $100, Medicare would have only covered about 20 visits per year.

Beneficiaries were receiving notices titled, “Advance Beneficiary Notice of Noncoverage.” The notice will tell you what Medicare will can or cannot continue to cover so that you can make informed choices about whether or not you want to continue your physical therapy.

Thankfully, physical, occupational, and speech therapy patients with Medicare won’t have that problem in 2019.

Medicare Physical Therapy Billing

When it comes to paying the bills for your physical therapy, you may want to consider adding either a Medicare Advantage plan or a Medicare Supplement plan. Even though Original Medicare Part B covers physical therapy, the cap will hold you back. Adding Medicare Advantage or Medicare Supplements may give you the coverage you need to pay the bills.

The good news is that everyone who is eligible for Original Medicare is also eligible for Medicare Advantage and Medicare Supplement plans. You can’t have both, so you’ll have to choose one.

Medicare Advantage plans are offered by private insurance companies and are designed to add additional covered services like dental, vision, hearing, fitness.

Alternatively, Medicare Supplement plans do not provide coverage for additional services but instead provide additional financial coverage. These plans are designed to help you pay for your coinsurance, copayments, and deductibles. You’ll have to decide what makes the most sense for you and your needs: more financial coverage, or more covered services?

Common Conditions That Physical Therapy Can Treat

Physical therapists can help treat a wide variety of medical conditions, depending on their specialty.

Some conditions that can benefit from physical therapy are:

- Cardiopulmonary conditions, such as chronic obstructive pulmonary disease (COPD), and cystic fibrosis

- Hand therapy for conditions such as carpal tunnel syndrome and arthritis

- Musculoskeletal issues such as back pain, and rotator cuff tears

- Neurological conditions such as stroke, spinal cord injuries, Parkinson’s disease, multiple sclerosis, and traumatic brain injuries

- Women’s health and pelvic floor dysfunction, such as urinary incontinence

Other conditions that may benefit include burns, wound treatment, and diabetic ulcers.

What Are the Benefits of Physical Therapy?

Depending on the your reason for treatment, physical therapy benefits can include:

- Pain management, which can help reduce the need for opioids

- Avoiding surgery

- Increased mobility and improved movement

- Injury recovery

- Stroke or paralysis recovery

- Fall prevention

- Improved balance

- Management of age-related medical issues

Your physical therapist can discuss the physical therapy benefits specific to your condition and personal medical history.

Does Medicare Cover Transportation to Physical Therapy Appointments?

Original Medicare does not cover non-emergency medical transportation. Some Medicare Advantage plans can cover Medicare transportation benefits including travel to and from doctor’s appointments.

How to Find a Physical Therapist Who Accepts Medicare

Finding a local physical therapy practice that takes Medicare may be easier than you think. If you’re looking for physical therapy near you, click here to get started. Medicare.gov’s Physician Compare website allows you to find providers who specialize in the services you need including physical therapy.

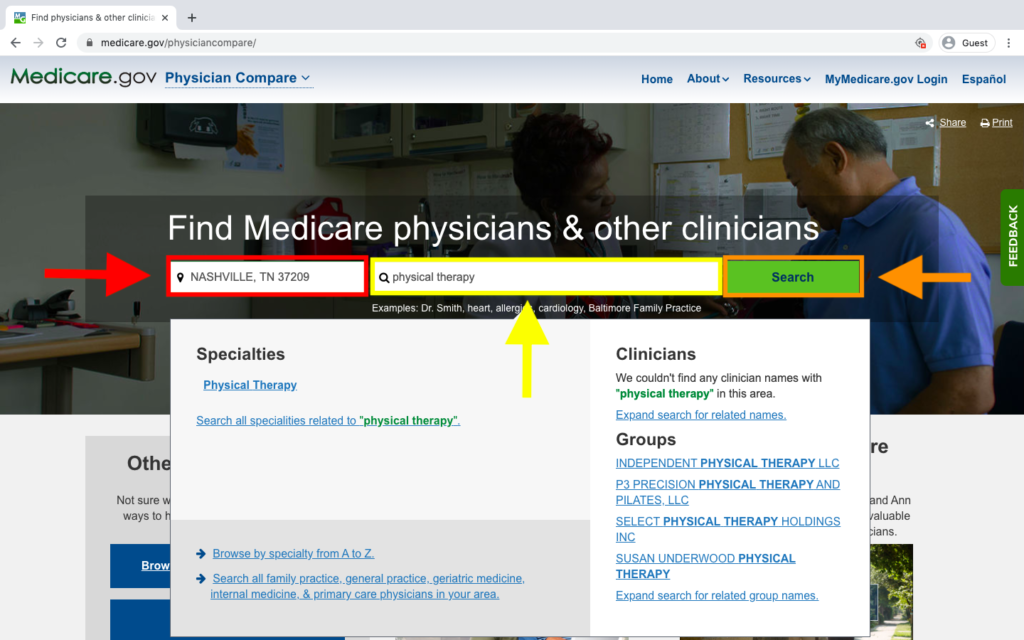

Enter your zip code beside the red arrow. We used our home office’s zip code in Nashville, Tennessee, which is 37209. Then type “physical therapy” in above the yellow arrow. After that, click “Search” beside the orange arrow.

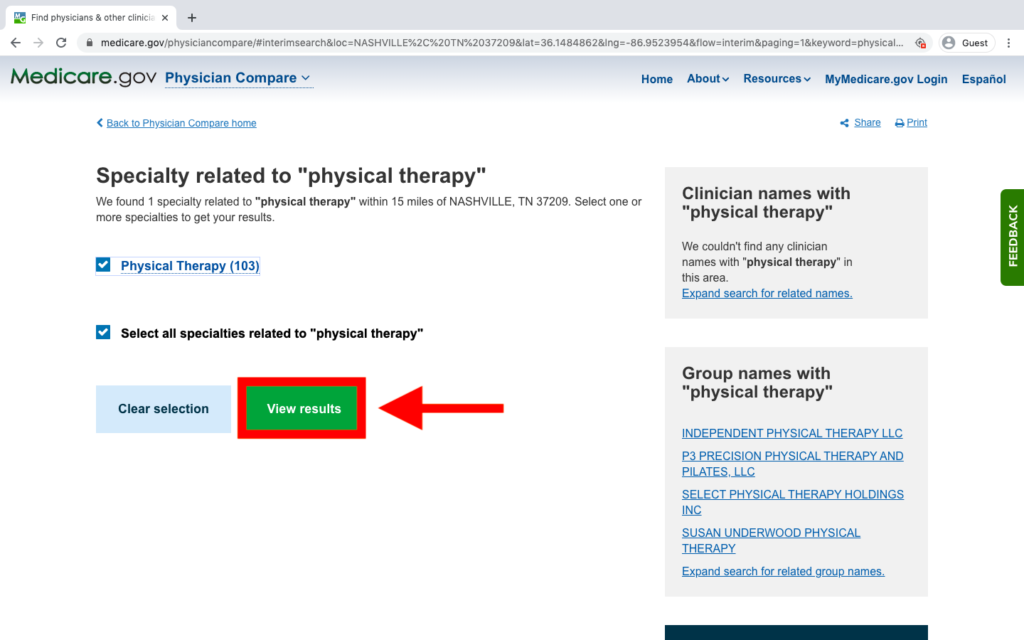

You confirm the service you need on the next page. If the boxes beside “Physical Therapy” and “Select all specialties related to ‘physical therapy'” are white, click in them to make both boxes have check marks. Then click “View results.”

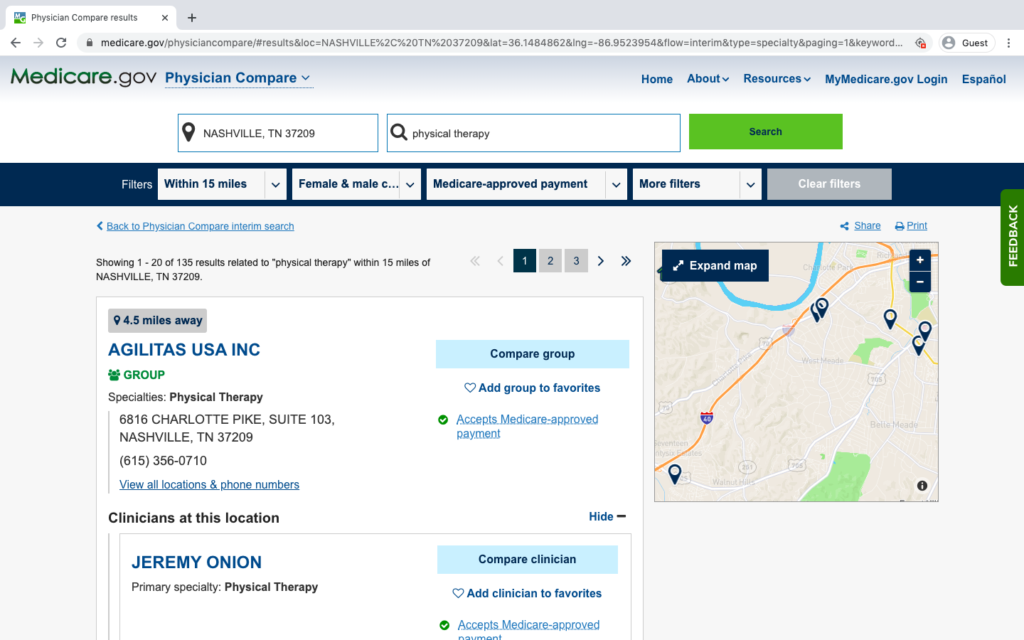

The last step is scrolling through the list of providers and making some calls. You may have to call more than one physical therapy practice to find one that fits your medical and budget needs.

Need a New Medicare Plan?

Our agents can help you decide if Medicare Advantage or Medicare Supplements are right for you. We have agents in 38 states and we’re constantly growing!

Plus, our agents are licensed to sell plans from many of the major insurance carriers in your area, which means we are NOT biased. We can help you set up an appointment with an agent who can show you how to choose the right Medicare plan for your needs.

Most seniors and Medicare beneficiaries will have to wait until AEP (October 15 to December 7) to change plans. Check out our post about Special Election Periods to see if you qualify for a SEP. Not sure if you qualify? That’s OK. Your licensed agent can help you find out if you qualify. Give us a call at 1-844-431-1832 or click here to have Medicare Plan Finder call you.

This post was originally published on January 4, 2018, by Anastasia Iliou, and was most recently updated on January 6, 2020, by Troy Frink.