Retirement and Medicare Eligibility

November 15, 2019What happens to your health insurance when you retire? Medicare and retirement can seem intimidating, but we’re here to ease some of your concerns and answer your questions.

There are currently an estimated 70 billion baby boomers who are nearing retirement. Planning for retirement is crucial to living a comfortable and healthy life. An annual estimate by Fidelity shows the average couple retiring at age 65 will need $280,000 to cover health-related costs. Fortunately, Medicare can help, but there is a set of guidelines and regulations regarding enrollment.

How Medicare and Retiree Coverage Work Together

Some employers may offer retiree health coverage, which can be a good option if you are not yet 65 and do not meet other Medicare eligibility requirements. If you are 65, it may be time to enroll in Medicare.

If you are already 65 when you retire and are interested in having both retiree coverage from your employer AND Medicare, the two can work together.

Your Medicare coverage will always come first. Your retiree coverage will work as extra coverage to backup your Medicare plan – kind of like a Medicare Supplement plan.

While retiree coverage is not a Medicare Supplement plan, it is very similar. It can cover things like copayments and deductibles, or even extra hospital stay days. All retiree plans are different, though, so look over your plan and call your insurance agent (or your former HR representative) to find out what it covers.

Do Retirees have to Pay for Medicare?

There are two parts to Original Medicare – Part A and B. If you have worked and paid Medicare taxes for at least 40 quarters (about 10 years), you can have premium-free Part A. If you did not work the 40 quarter minimum, then you will have to pay the Part A premium. For 2020, the Part A premium is $458 for 30+ quarters or $252 for 30-39 quarters.

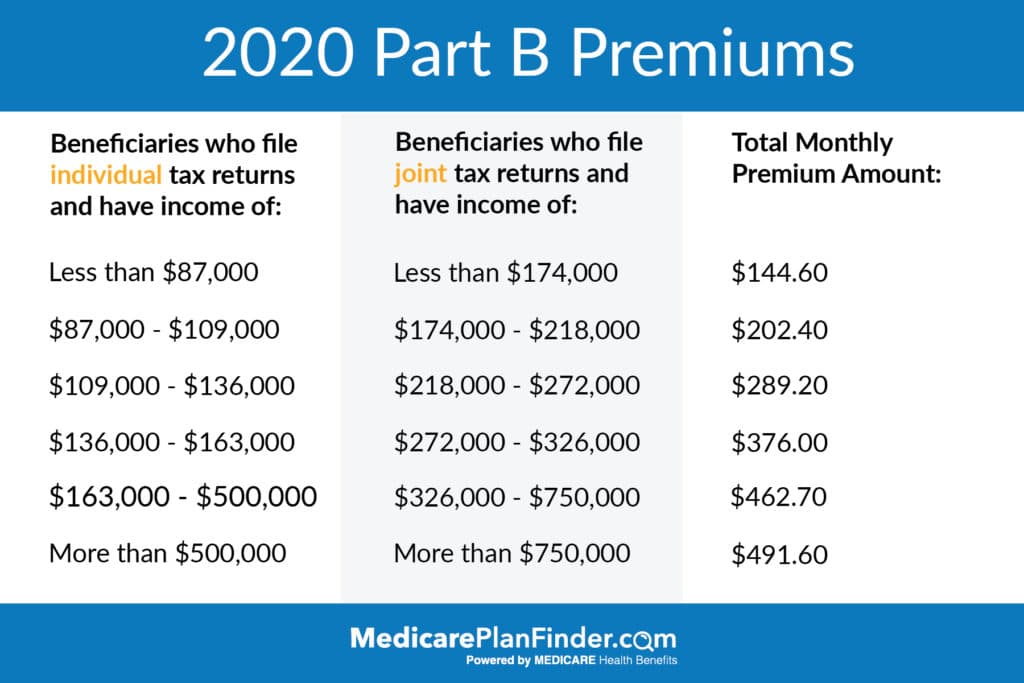

The standard Part B premium for 2020 is $144.60, but you may pay more or less based on your own set of circumstances. An estimated 3.5% of beneficiaries will have a lower premium due to the Social Security “hold harmless” provision which prevents premiums from exceeding Social Security benefits. Plus, if you make more than $87,000 a year, your monthly Part B premium will be adjusted based on your income. The income-based 2019 Part B premiums are as follows:

Do you Automatically get Medicare When you Turn 65?

If you currently receive Social Security benefits, you will be automatically enrolled in Medicare Parts A and B the month you turn 65. However, if you do not receive Social Security benefits, you will need to enroll yourself. Medicare enrollment begins three months before your 65th birthday and will end three months after. This is called your initial enrollment period.

It’s important to act right away because delaying your enrollment can result in a 10% Part B premium increase for every year you’re eligible but don’t enroll. If you don’t select prescription drug coverage and later enroll, you may have a penalty of 1% the national base Medicare Part D monthly premium for each month you were not enrolled.

Health Insurance After Retirement Before Medicare (Early Retirement)

Should you keep working or retire early? Your decision may be influenced by your age, health, budget, Medicare eligibility, social security benefits, and employer coverage.

Employer Retiree Coverage

Some employers offer retiree coverage after you leave the company. However, retiree coverage and Medicare are not the same. Retiree coverage is health coverage that is provided to former employees of a company. This typically pays second to Medicare, which means you still need to enroll in Medicare to be fully covered. However, retiree coverage can help with health-related expenses if you retire before 65.

Not every employer offers retiree coverage. Since it isn’t required, your employer (or former employer) can cancel or change your retiree plan at any time. It’s safest for you to have Medicare as well. Plus, if you don’t enroll in Medicare when you first become eligible, you will face a penalty fee. Some retiree plans automatically stop when you turn 65 and become eligible for Medicare.

If your employer does not offer retiree coverage, retiring or losing your job gives you a SEP. A Special Enrollment Period means that you don’t have to wait for AEP, the Annual Enrollment Period, to buy coverage. You will have 60 days from your last day of work to enroll in a marketplace health plan. After those 60 days are over, you’ll have to wait until AEP (October 15 – December 7) to buy a marketplace plan, at which point you will be charged a penalty fee for having a lapse in coverage.

FERS/CSRS Retirement and Medicare

The CSRS, or Civil Service Retirement Act, became effective on August 1, 1920. It was replaced by the Federal Employees Retirement System (FERS) on January 1, 1987. Some people may still belong to CSRS. Both programs are for government employees only.

Both FERS and CSRS allow you to retire at age 62 if you have five or more years of service or at age 60 if you have 20 or more years of experience. Under FERS, you can retire between ages 55 and 57 (depending on your birth year) if you have 30 or more years of service.

Regardless of your FERS or CSRS status, if you’re 65, you’ll qualify for Medicare. You’ll also qualify for Medicare if you have a qualifying disability. If you are under 65 and do not qualify for Medicare, you can receive your FERS or CSRS benefits but will have to wait until you reach Medicare qualifying age.

Until then, you may qualify for the Federal Employees Health Benefits Program (FEHB). Once you do become eligible for Medicare, you may want to enroll in Part A anyway because there is no premium if you’ve worked for at least 40 quarters.

COBRA

When you leave your job, you’ll also have the option to enroll in COBRA. COBRA allows you to continue to belong to your employer’s group plan for a temporary period after you leave the company. The company can “kick you off” at any time, so this is not a permanent option. However, COBRA can help you out while you figure out what your other options are.

Ask your employer or your HR representative to find out what COBRA might look like for you.

Can you get Medicare at age 62?

It’s important to understand the differences between Social Security and Medicare. You can start to receive Social Security retirement benefits at the age of 62. This amount is typically reduced until you reach the age of 65. The average person does not qualify for Medicare until age 65, but there are exceptions.

You are automatically enrolled in Medicare once you have received Social Security benefits for two consecutive years. This means if you started receiving benefits at age 62, you will qualify for Medicare at age 64. Plus, you may qualify for Medicare before 65 if you have Lou Gehrig’s Disease (ALS) or End-Stage Renal Disease.

Importance of Planning for Retirement

It’s never too early to start planning for retirement and Medicare. Our licensed agents can help explain your coverage options and answer all of your questions. Plus, they can provide bias-free assistance with a wide range of plan options because they are licensed with all major carriers in your state. Start planning now! Call us at 844-431-1832 or fill out this form to arrange a no-cost, no-obligation appointment.

This post was originally published on December 27, 2018, and was last updated on November 15, 2019.