The Shocking Truth About Medicare and Dermatology

July 3, 2019Does Medicare cover dermatology?

Medicare coverage for dermatology can be quite limited. If you or your loved one needs treatment NOW, take a look at your coverage before it’s too late and you’re stuck with a big bill!

Medicare Part B can cover some dermatology services. If your condition is medically necessary, Part B will cover doctor services relating to evaluating, diagnosing, or treating skin conditions. Medicare will not cover cosmetic treatments, and it will only cover skin cancer screenings if you are showing symptoms.

How Does Medicare Cover Dermatologist Visits?

For dermatology-related services, you will have to meet your Part B deductible first. For most people in 2019, the deductible will be $185.

Then, Medicare will usually pay 80% of the service cost. You will be responsible for the remaining 20%. For Medicare to cover that 80%, your dermatologist or physician must accept Medicare assignment. Your doctor should be able to tell you whether or not they accept assignment, but if you’re not sure, your insurance carrier or insurance agent can help you.

Some Medicare Supplement (otherwise known as Medigap) plans can cover the rest of your costs, like your deductible and the remaining 20%. If you’re interested in investing in a Medigap policy, one of our agents can help. Click here to get started on setting up your free Medicare Plan Finder appointment.

Uniquely, Medicare plans are now able to cover MyPath, a genetic test for malignant melanoma.

How Much Does It Cost to Go to a Dermatologist With Medicare?

Dermatology costs vary based on what insurance you have, where you live, and what services you need. If you have Medicare (demonstrated above), you will likely be responsible for 20% of services. Some dermatologists accept Medicaid as well.

Keep in mind that in the cases of Medicare and Medicaid, your care will most likely not be covered unless it is determined to be medically necessary. For example, acne care is not generally considered a medically necessary treatment plan, but skin cancer removal is.

Thankfully, dermatology visits are not typically wallet-breaking. Depending on what doctor you see, where you live, and what services you require, The Law Dictionary says you may only need to pay between $100 and $200, which is a low cost compared to other health services, like hospital stays.

Do You Need a Dermatologist?

We’re not doctors, but chances are that if you’re asking this question, you should go and see a dermatologist.

Some skin conditions that you may start to notice as you age are dry and itchy skin, benign growths, loose skin (especially around the eyes, cheeks, and jawline), transparent or thin skin, spotting, wrinkles, and easy bruising.

While those are all certainly typical signs of aging, there are steps you can take to keep your skin healthy and prevent further damage, like:

- Don’t stay in direct sunlight for long periods of time.

- Always use a sunscreen with SPF 30 or higher when spending time outdoors.

- Stay away from tanning beds.

- Check your skin or have a loved one check your skin for new growths or moles that appear to be changing in color or size.

- See a dermatologist whenever you face a new concern!

Questions to Ask Your Dermatologist

Knowing what questions to ask your doctor can be a challenge, especially if you are really unsure of what’s wrong. We searched the internet and compiled this list of questions you may want to ask your dermatologist:

- What foods should I avoid for my skin health? What should I be eating more of?

- How can I slow down signs of aging, like wrinkles and dark spots?

- Are my freckles and moles cancerous?

- How can I check my own moles and how do I know when to call you?

- What lotions and sunscreens do you recommend?

- These are the skin products I use now (list sunscreens, lotions, exfoliators, makeup, etc.). Are they damaging?

How to Find a Dermatologist

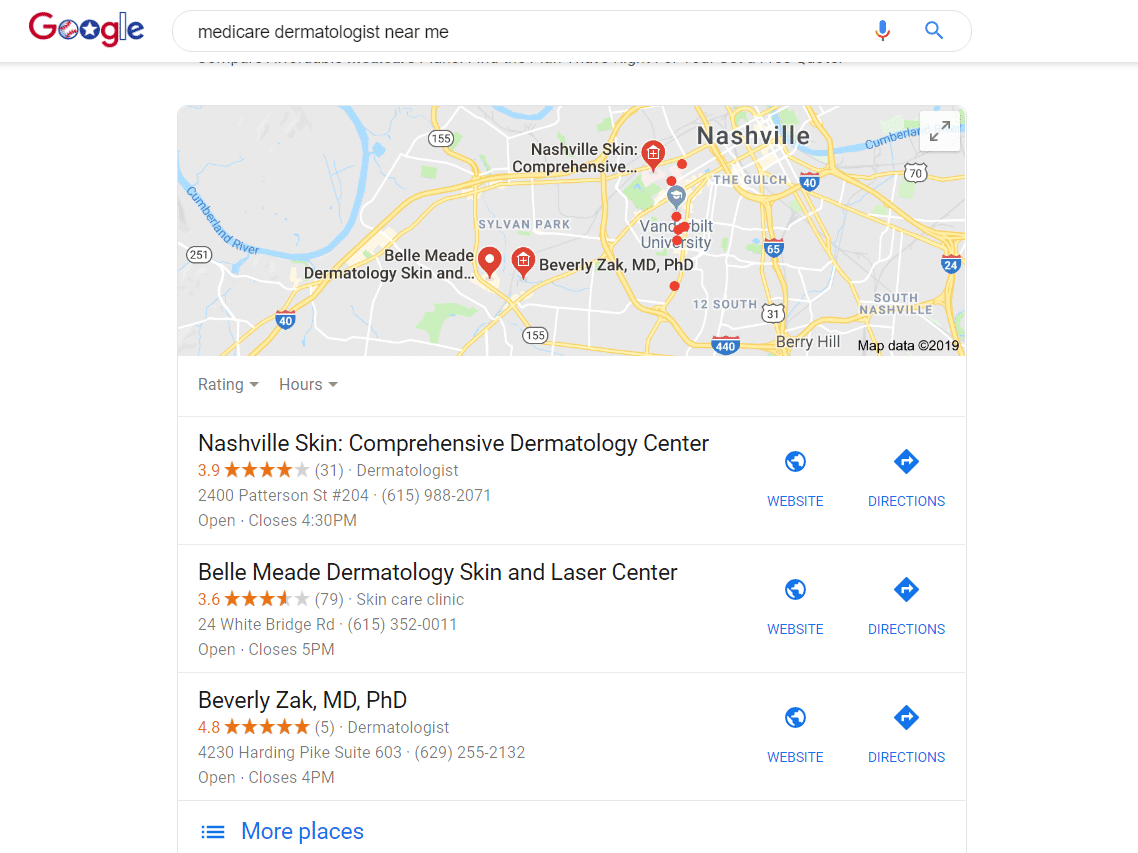

To find a dermatologist near you, you can visit a site like “doctor.com” or perform a Google search. Usually, searching for “dermatologist near me” pulls up reasonable results. For example, these are the results when we searched from our office in Nashville.

Once you’ve looked at reviews and found some good dermatologists in your area, make sure they accept Medicare. If you have another plan that you’re using, like Medicare Advantage, make sure the dermatologist is in your plan network.

Dermatologists are specialists. If you have an HMO (Health Maintenance Organization) plan, you may need a referral from your primary physician before you can see a dermatologist. If you aren’t sure whether or not you need a referral or if you need help finding a dermatologist that is in your network, call your insurance agent!

A highly trained, licensed insurance agent can help you walk through the process of finding providers in your network and can help you make sure you have all the coverage you need. Don’t have an insurance agent? To set up an appointment with your new agent, give us a call at 844-431-1832.

*This post was originally published on June 28, 2018, and updated on July 3, 2019.